Monthly Issue

From Home Furnishing Business

February 8,

2015 by in Industry

By Tom Zollar

In the aftermath of the devastating Great Recession, we have tracked and reported the evolution of the consumer coming into your stores. They differ dramatically from the people we saw during the down turn.

Whether that change comes from a pent-up desire to finally buy something new for their home or perhaps a need to update their lifestyle, they are definitely on a mission. These directed, or driven, consumers tend to be more inclined to make a buying decision and are usually more selective in what they purchase – often being more focused on style and quality than before. Add to that the increased confidence gained from online research and a very high percentage of them arrive at your door ready to rock and roll.

Just as important, most home furnishings stores saw traffic levels return to pre-recession levels or higher last year. In fact, a lot of retailers, particularly those located in markets with better economic conditions, have been able to drive significant increases through aggressive advertising campaigns and high quality online marketing efforts. As a result, many enjoyed healthy business and, in some cases, record months during last year.

This is all good news, but when we look at year-end results, the real questions should be: Are we doing the best we can? Are we maximizing the potential this new customer and today’s marketplace offers us? Or, are some of us missing a great opportunity?

Before you answer, here are some things to consider:

· If today’s consumer comes into your store more driven to buy, more interested in better quality goods and more willing to custom order, then both close rate and average sales should be increasing for you. Are they?

· If the above is true, then even if your traffic was flat or only up slightly, you should have increased your sales nicely. Did you?

· If you increased your traffic, then your sales should have grown at an equal or greater rate as your traffic. Was that the case?

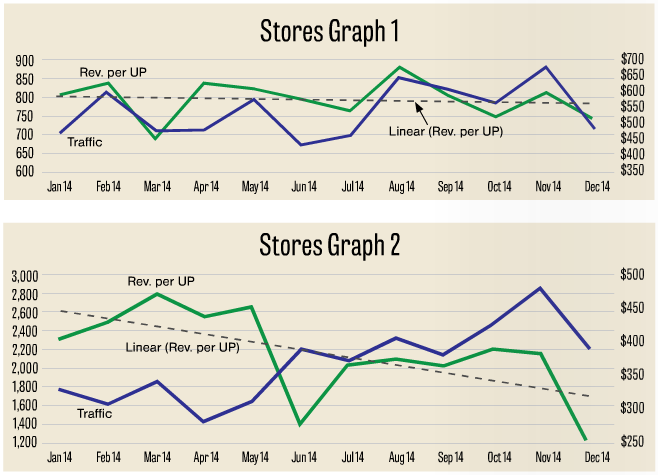

The bottom line is this. If store traffic was flat or only up slightly last year, a retailer still could have increased sales nicely by raising revenue per up, but for many that did not happen. Even in some stores that brought in more people than the year before, we saw flat or decreased sales. In several cases the percentage increase in sales was less than the increase in traffic. The only way that can happen is if revenue per up declined. This means they actually sold a smaller percentage of their traffic and/or sold each one less than they did in the previous year. Again, given today’s more driven, mission-oriented shopper that should not have been the case.

Here are two relatively extreme examples of what we have seen:

So what happened at stores that haven’t seen the level of improvement they could have potentially achieved?

The common denominator is in the area of staffing and the store’s ability to properly service the traffic they got. During the recession we saw most retailers downsize sales staffs by letting weaker ones go and through normal attrition. Since traffic was down, many of those people were not replaced. As the industry recovered, traffic did not jump for many stores, so they did not feel an urgent need to add staff. Often this is the result of pressure from the existing members since most sales people think more ups is the answer to their needs. We know there is a limit to how many customers each member of our staff can properly handle without seeing productivity drop. It varies greatly from person to person depending on selling style and how much design work they do, but everyone has a sweet spot and when they pass it, their efficiency and effectiveness go down.

The issue got even more complicated for some stores last year when even with staffing levels were historically adequate for traffic counts, they struggled to get the most out of it. A possible reason being that if you now have more customers interested in custom ordering products and redoing rooms than before, then they will most likely need more time to complete the sale – which means salespeople can’t properly interact with as many customers as they did before. Therefore even with the same size staff we might not be able to take advantage of our opportunities and maximize each sale.

In the above store examples, the first one added staff last year and while the second store added replacement staff holding staffing the same as the previous year.

The key factor seems to be that those stores that maintained. or enhanced. their level of service to the consumer, missed fewer opportunities and increased their revenue per up. They did this by allowing staff enough time to work with every potential client they greeted, so they could build the relationship each one wanted, solve individual problems, build dream rooms and maximize each sale. The stores that did not match their staffing level to the increased demands created by traffic and the needs of today’s consumer, saw a decrease in performance with each customer, leading to more missed opportunities and not achieving their potential.

This is pretty basic stuff for an experienced retailer. We know how important staffing is and how much it means to business, but in many cases we don’t know how to find the magic number. Instead, we end up going by gut feel or listening to our team. If that works for you, then keep it up. However, if you want a better picture of how many ups your staff can handle and still deliver peak performance, consider the following.

The best way we have found to determine each person’s ups sweet spot is by tracking, reporting and studying the relationship between traffic level and revenue per up for your store and each salesperson. While the obvious way to calculate revenue per up is to divide total sales by total ups, you might not know that multiplying closing rate by average sale gives you the same number. High school algebra would look like this—If Revenue = Ups x CR x AS, then if you divide both sides by ups you get Revenue/Ups = CR x AS.

Since closing rate and average sales are the main ingredients in a sale that the sales person delivers, then logically it means revenue per up is the best indicator of how well a person performs with the ups they have. It is a true reflection of efficiency and effectiveness. Therefore, if we track revenue/up movement compared to the number of ups a salesperson has each month, over time we begin to get a clear picture of how they perform with varying amounts of traffic. Doing the same for the entire store tells us how the sales team does. By putting it into a graph, it is easy to tell when we are missing opportunities by having a dramatically reduced revenue per up.

Below are examples of some store and individual results. The black line reflects the number of ups per month and the solid green line indicates the revenue per up each month. The dash green line is a trend line based on a two-month running average.

Stores:

Individuals:

It is fairly easy to see the impact the level of traffic has on the performance of both stores and individuals. There is always a point of diminishing returns, where the return you are getting from each up you bring in begins to sink. As you move past that the revenue per up continues to decline until at some point you are actually serving more people and selling less or at least not selling as much as you should be selling.

Our recommendation is to be very careful how often you let your floor go into overflow. That is when you see your staff’s efficiency and effectiveness sink to its lowest level. Chances are you lose more business on the busiest days than you do on all the others put together, and it is not necessarily because no one talked with them. Instead, they became a missed opportunity because they were not properly cared for by an overworked sales person.

Editor’s Note: Tom Zollar is retail operations practice manager for Impact Consulting where he creates and delivers sales training for retailer sales associates and managers, facilitates retail performance groups, coaches managers and helps retailers grow their business. In other words, he’s our resident coach … without the whistle.

January 12,

2015 by in Customer Service, Industry

Whether you know it or not, like it or not, your store is a brand.

Maybe not a brand in the classic sense of mega names such as Coca Cola or Apple, but everything you say in your advertising, every touch point you make with shoppers, gives consumers a sense of what you’re all about.

You’re projecting an image to the people in the markets you serve. Working to ensure that projection lives up to what you offer—and vice versa—is what we’re talking about this month in Home Furnishings Business’ first issue of the New Year.

We asked several retailers to describe the brand image they want potential customers to associate with their store; and whether that’s changed over the years, or remained consistent.

Keeping it Real

“The image we project and want to be perceived as being is one of offering quality products at a great value with the best customer service available,” said Woody Whichard, president of Midtown Furniture Superstore & Mattress Center, Madison, N.C. “We strive daily to meet these expectations. This has been part of our vision since we opened in 1977. Even though I am a second-generation retailer this has not changed. We believe that this is why people call Midtown Furniture their furniture store, and come back again and again.”

Whichard’s been front and center in Midtown’s promotions (see Sidebar: Personal ID) for years, but lately Midtown has let its customers do some of the talking.

“For the past year we have run most of our TV ads with our customers in them,” he said. “We called a few customers, and had a few walk in during production, and asked if they would like to do a testimonial for us on TV. All that were asked and available when we produced were excited to help us out.

“Now we are talking about real people talking to real people. That is about as personal as you can get. These commercials have no sense of urgency. They are only brand-building ads that allow new customers to hear from a real person, like them, that we offer quality products at a great value with the best customer service.”

Dealing with the Big Guys

Hillside Furniture, a high-end contemporary furniture specialist, operates in the Detroit market, home of one of furniture retailing’s regional giants, Art Van Furniture.

President Jeff Selik has all the respect in the world for what he called the area’s “brand leader,” but said a retailer such as Hillside has to work that much harder to tell its story to potential customers.

Hillside’s brand image has been consistent: family owned, local, small, geared toward people who want to “shop local

“We project 'unique, very contemporary,'” Selik said. “We want to have that as our overall brand, and private labeling is a key to keeping your store exclusive in your market. When people walk into Crate & Barrel or Pottery Barn, they ask 'who makes that sofa?' They're able to say 'They make that for us.' It creates an exclusive outlet for that brand.”

Hillside’s association with the Contemporary Design Group merchandising consortium has helped in that regard. The buying group has worked hard to help members identify themselves as the go-to resource for upscale contemporary goods in their respective markets.

One example: CDG negotiated a deal to offer members the chance to create customized, magazine-format mailings—or “magalogs”—to a targeted list of customers. (Disclaimer: Home Furnishings Business created and published the magalogs for the group and continues to work with a number furniture retailers on similar projects.)

“The magalogs are a total brand-builder,” Selik said. “When people flip through those pages at home, they should get a sense of what it's like to visit and explore Hillside.”

Staking a (Believable) Claim

“Our brand image from the beginning has been ‘the best furniture value in Alaska,’ and that continues to this day,” said Ron Bailey, president of Anchorage-based Bailey’s Furniture. “We endeavor to buy wisely, contain our expenses and offer the best possible prices, everyday, for our customers.”

Bailey’s also isn’t afraid to point fingers to differentiate itself from the competition.

“Our brand is believability and trust,” Bailey said. “We constantly advertise and educate our customers about the ‘unbelievable’ price swings of our competitors, and I believe that we are making headway.”

On that note, it should surprise no one that consumer research from Impact Consulting's FurnitureCore arm says "believability" is a key part of making furniture stores' advertising connect with shoppers.

Consumers don’t resent ads that seem too good to be true, they just ignore the stores running them, said Lance Hanish, principal of Scottsdale, Ariz., agency Sophis.

“They don't hold it against them, they just won't go to that retailer,” he said. “It's an immediate, visceral attraction as to what you believe in.”

Brad Lebow, president of Horich, Parks, Lebow Advertising, Baltimore, Md., said believability can depend on the messages consumers in particular markets are accustomed to.

“We want to be credible and believable, but we also want to promote and entice. At the end of the day, consumers want a deal,” he said. “It depends on the playing field, and it's a question of what consumers in a market are used to seeing.”

When people see ‘70 percent off,' they know that’ just to get them into the store, said Jason Pires, CEO and senior creative director at MVC Agency in Los Angeles.

“I think overall ads are believable,” he said. “For me, it's more than just being an offer or promotion. The brands that are smart create a lifestyle-centric approach that respects the consumer.

“We bought furniture for our office the other day, and the company had these catalogs showing this sexy—fully clothed—woman on the back cover. The spine of the chair looked, how do I say, like a part of a woman's anatomy. If that looks condescending to me as a guy, imagine how that looks to a woman. For you to treat a woman in an ad the way they were in the '50s or '60s, that's just unbelievable.”

Whose Voice?

FunitureCore’s consumer research also indicates that celebrity endorsements don’t resonate with consumers, and the industry certainly has its share of licenses with high-profile names.

One reason Whichard plays his on starring role in Midtown’s promotions is that “I am real.”

“The customer can come in the store almost any day we are open and meet me. I have passion about our store,” he said. “A celebrity has passion for doing their job and being paid for it without a clue as to who or what your store is about. This works for some customers, but I feel that our customer wants a real person.”

While Hillside has invited local athletes to participate in its charitable work, the store doesn’t depend much on linking well-known names to its promotional efforts.

“I don't have a budget for celebrity 'endorsement.' For me, a lot of it's your image and branding,” Selik said. “Charitable efforts are a brand builder, and it does good in the communities where you operate.

“Paid spokespeople are clearly just that. In general, they don't come across as credible. I'm president of this company, and I'm second generation here, so I'm committed.”

Hanish pointed out that celebrities such as Cindy Crawford and Oscar De la Renta have met with success in furnitureland.

“There are two things about celebrity endorsements,” he said. “One, the company who is proposing to use a celebrity; and two, it depends on the celebrity. The key here is you have a client who really wants to make it work. Their magic can't just rub on off on you.

“Anything can work if it works in a unified message, and you'd better make the investment to support that effort--his or her aura alone won't take you to a new level.”

Lebow at Horichs Parks said that from its

client base's experience, a celebrity association raises awareness for a short period of time, but most haven't stuck with it for the long term.

Done with a strategic approach, famous names can help, believes Pires at MVC.

“They can be fantastic if it's in combination with the rest of your strategy. I believe they do work if it's done right,” he said. “It's always better to have someone refer people to you versus saying it yourself.”

Where to Promote

It might surprise some in this digital age, but FurnitureCore’s consumer research indicates direct mail and newspapers remain effective media, with more than 30 percent of consumers saying those would encourage them to shop for furniture instead of other media—i.e. television, radio, social media, e-mail.

Whichard says direct mail print has worked very well at Midtown.

“You have to do a lot of planning for this type of advertising,” he said. “You have one shot to get their attention from the mailbox to the trash can. Direct mail is usually a onetime shot so you better make sure you are offering them something they desire or you will be forgotten tomorrow. Most people do not leave their mail out like they will a newspaper. You can get a few days and extra eyes on a newspaper advertisement. Direct mail can be substantially more expensive way to advertise compared to newspaper.

He doesn’t feel newspaper advertising is as effective as it used to be.

“I like to use newspaper to reinforce the message I have on TV,” Whichard said. “Also newspaper gives you an opportunity to reach your direct-mail recipients a second time with a reduction of the cost. There are effective newspapers and other newspapers. Make sure that the newspaper and the ad placements are a reflection of your business and that they reach the target audience you desire.

“We have a small local paper that is very effective. The price is less than the large city papers and it targets the same customers that we do. It is a weekly paper that is well read by its readership. It is direct mailed to their homes at no charge, and this a great bonus. My prospective customer did not have to buy my ad to see it, nor were they only given an ad to throw in the trash. It has value. What I see is most effective is a good mix of all medias. We have a diverse customer base and different demographics are reached in different ways. We try different things to reach customers in unique ways, but we keep our main focus and our budget on what customers are responding to right now.”

Selik at Hillside also believes in a discriminating approach to print.

“I certainly see that if it's in the right newspapers, it's still effective,” he said. “I'm very selective, and the one I work with, the Detroit Free Press, gets a lot of response.”

He also is a fan of printed post card mailings: “It's tangible, something people still hold in their hands, and it's pretty inexpensive.”

Bailey is more sold on the airwaves for promotion.

“We are 80 percent TV, 10 percent radio, 10 percent Web and others,” he said. “Our traffic continues to be strong, and we are up double digits for the year in sales. We do not offer huge discounts and mark prices up and down, but rather everyday low prices and offer the same prices on our Web site.”

Lebow at Horichs Parks Lebow said Impact’s findings don’t quite jive with what he’s seen in the marketplace, but that direct mail absolutely remains an important component of a promotional strategy.

“Our clients do that eight to 12 times a year, and that's more than it used to be,” he said. “Number one, direct mail retains existing customers. We also use it as a customer-acquisition tool for people who aren't our customers, but who should be.”

He suggests that retailers should use direct mail to target people who've shopped for the products they offer, but for whatever reason haven't checked out their store or Web site.

Regarding newspaper advertising, Lebow said the issue today is how fast circulation numbers are shrinking.

“Newspaper (advertising) is one of the first things to go when people have to fund other channels,” he noted. “We find we're lessening print advertising to fund digital initiatives. That's the trend within our client base now.

Print does remain viable, said MVC’s Pires.

“If a particular type of media doesn't work, it's a matter of how they're using that media and delivering an overall consistent message,” he said.

“It's all about strategy, positioning and knowing what you're about as a company. It's not what you're telling people, it's what they experience. You can't fool people for very long, and in a competitive market like LA, you can't fool them at all.”

Whatever your advertising mix, make you’re you pay attention to where a lot of shoppers get their first impression of your store—online. Hanish noted that the Web site is to shoppers today what store window displays were in the 1950s.

“Web site traffic is today's window-shopping,” he said, adding that the key is to put that vehicle to work in new, innovative ways to ask shoppers to come into the store. “In our industry, too many don't understand what she's doing today. The data from all this information we're accumulating--we're going to have to adapt that information to our approach.”

Closing the Deal

A believable, real impression is the key to brand-building promotion that makes for repeat customers.

“You have to be believable, because when they do come to shop they want to have the same emotion you created in your advertisement,” Whichard said. “You better not over sell your store, or they will be disappointed and never return. We shoot our commercials in our store, and the advertisements show people what they will expect when the walk in. We do not use product shots to show furniture, we use the furniture with the background showing more of the store. We want to be believable and create the same emotions that brought them in in the first place.”

Especially in markets with a dominant player, independents have to differentiate through advertising, product assortment and culture. Dealing with an 800-pound furniture gorilla in your market?

“His size means I have to be more nimble--where we spend our advertising dollars, our product assortment,” said Hillside’s Selik. “We have to offer the furniture, service and experience that's different from any place else in our market. When your brand can be 'the best at what you do,' you can differentiate. You don't have to be the biggest, but you want to be consistent.”

January 12,

2015 by in Retail Snapshot

When you think of major U.S. markets, your eye might gravitate toward the seaboards. The Minneapolis region, home base for HOM Furniture, might be a familiar name across the country, but it remains among the nation’s metropolitan areas second tier.

That doesn’t mean it’s a dull market for home furnishings retailers.

“I am not going to lie—business has been challenging and it always will be,” said Kyle Johansen, merchandising manager at Coon Rapids, Minn.-based HOM. “No one is going to just lay down and let us take their market share. We have a lot of very tough competitors who keep us on our toes every day. Everyone is here and Minneapolis is only the 16th-largest market in the U.S.”

The region’s home furnishings retailers include Ashley, Slumberland, Schneidermans, Becker Furniture World, Macys, Mattress Firm and Ethan Allen—as well as lifestyle retailers such as Pottery Barn, Restoration Hardware, Room and Board, Crate and Barrel. Don’t forget the big box guys in the game now such as Menards, Costco, Target, Big Lots and Ikea.

“Did I mention the online retailers like Wayfair and Hayneedle?” Johansen said. “We are always looking to keep our showrooms unique with fresh assortments and staffed with great, engaged people to compete with all those other outlets for furniture.

“Since we offer sofas from $267 to $20,000, everyone is our competitor. We do not have the luxury of being a niche store who only has to beat others selling, for example, high-end contemporary or low-end RTA.”

You might not have been there, but you’ve heard of Minneapolis—you’ve probably heard of HOM Furniture, too. The retailer has prospered in the upper Midwest through developing its namesake stores for appealing to the specific markets they serve; spreading its reach into upper price points through acquisition (Gabberts); and acting on retail trends that scream “value” to consumers (Dock86).

Now, HOM operates 15 namesake showrooms; three Gabberts Design Studio & Fine Furniture showrooms; and two Dock86 showrooms in Minnesota, Iowa, North and South Dakota and Wisconsin. Those combined for 2013 revenue approaching $216 million.

Starting Small, Ending Big

HOM Furniture’s roots go back more than 40 years to 1973, with the founding of JC Imports. Wayne Johansen (Kyle’s uncle) opened a small wholesale and retail import gift business in partnership with his uncle and mentor, Bill Christensen, who’d been paralyzed in an accident at age 19.

The two would drive down to Mexico, where Christensen found affordable treatment and his nephew found affordable merchandise and jewelry

In 1979, a friend convinced Wayne to convert one of his retail gift shops into a waterbed retail outlet, The Waterbed Room, which soon became the largest retailer of flotation sleep products in the upper Midwest.

Recognizing the need to expand product lines to capture greater market share, two HOM Oak & Leather showrooms opened in 1990. In 1993, to expand customer reach, all Waterbed Room showrooms were converted to Total Bedroom showrooms, along with further expansion of HOM Oak & Leather.

In 1996 HOM Oak & Leather and Total Bedroom were merged into one entity, HOM Furniture, making HOM a complete full-line furniture retailer.

The business continued to grow, and in 2008 Wayne, his brother, CEO Rod Johansen (Kyle’s father) and COO Carl Nyberg forged a deal to purchase high-end Minneapolis retailer Gabberts Furniture.

“The aspiration was to open Gabberts gallery stores across the upper mid-west to expand the brand in multiple markets,” Kyle Johansen said. “Today there is a Gabbert's gallery in Sioux Falls, Sioux City, Fargo, and opening in 2015 a second Minneapolis location.”

In 2009 HOM was on the move again and acquired Seasonal Concepts, one of the largest specialty outdoor and Christmas businesses in the country; merged the concept into HOM’s full line furniture stores and branded the department "HOM Seasonal Concepts" in every HOM Store.

2010 brought another year of brand extension as HOM opened a new concept showroom called "Dock86," playing off the "weekends only" and "The Dump" approach of offering high value with no frills and only open four days a week. A second location was opened in 2013 in Minneapolis adjacent to a new HOM showroom.

Filling the Floor, Selling the Product

HOM includes multiple brands (see Sidebar: Brand Extensions), but it seeks to tell distinct stories even on its namesake floors.

“Merchandising is a key component of any furniture showroom and we put a lot of time, money, and thought into how our showrooms layout from a sense of product flow as well as how vignettes are created and where our galleries are located throughout the store,” Kyle Johansen said. “We don't want every HOM Showroom to look exactly the same, so each HOM store will provide a different, yet similar, experience.

Each HOM showroom has its own design team of visual merchandisers, who get full authority to put whatever lamp, rug, cocktail table, and accessories in each vignette they choose.

“Even though all the product is the same it's offered in a different way in each showroom,” Johansen said. “These teams often meet together to share best practices and bring ideas to their stores.”

How would you like customers to cross-shop your floors if you have multiple storefronts?

“We often hear from customers they have a ‘favorite’ showroom they like to shop as well as customers who will shop multiple HOM locations,” Johansen said. “Our merchandising team consists of over 30 designers between all the stores and our corporate team. The HOM Stores are unique in the sense that we do a combination of gallery plus departmental sales.

Those galleries include "Fine Furniture" (higher-end lifestyle), "Seasonal Concepts" (outdoor and seasonal), "Uptown" (reclaimed, vintage, eclectic), "Amish Craftsman" (all Amish-made furniture), "Sleep Express" (mattresses), "Lodge" (rustic lodge cabin-style furniture made in Minnesota), and "Bargain Shop" (entry level price points such as $267 Sofa),

“We have a great group of buyers and merchandisers that make the showrooms pop and look fantastic,” Johansen said. “Our corporate merchandising teams visit the stores weekly to ensure everything is in perfection. They often ask us what the standard is. and we always say you need to look like the "Best HOM Store" you cannot compare yourself to a local competitor that perhaps has a low standard for merchandising or a low standard for store cleanliness.

“Our experienced buyers travel all over the world to get the best products at the best prices to give our customers the best value. Besides the U.S., we buy from Europe, Mexico, China, Vietnam, Malaysia, India, and Pakistan.

Beyond product, HOM emphasizes training for the people encountering the shoppers.

“We have a very talented group of stores sales associates that make a huge difference,” Johansen said. “No one wants to buy furniture from someone who says ‘Ya, this is a good brown couch and its cheap.’ We do extensive training with our sales teams before they even see the retail floor.

“Then they get further support training several times a year from our corporate sales trainer as well as buyer training, sales managers, and of course training by our mfg representatives. We even have a ‘HOM University’ online that everyone must enroll and pass.”

Telling Several Stories

Each HOM store has its own identity, logos, music, color scheme, and marketing approach based on the customers it targets.

“So, between the big three (brands) we are creating three different marketing campaigns each month,” Johansen said. “To make matters more confusing, each brand has sub-galleries, such as in Gabberts case Stickley; in HOMs case Uptown, Sleep Express, Amish, Fine Furniture, and Seasonal Concepts.”

He praised the efforts of Marketing Director Jerry Underwood and HOM’s internal marketing team for handling that array of messages.

“We shoot a lot of our own photography as well as TV commercials; and we do that internally, along with all the post production and editing work,” Johansen said. “We also do our own Web sites internally which is a huge undertaking by our buyers, and marketing and IT Teams. We have a social media manager who works solely on our Facebook, Pinterest, Twitter, and Houzz accounts.

“We even have our own media buyer who negotiates our TV commercial rates and placements in all of our markets.”

Full, 24-page Sunday go into local newspapers; and HOM also incorporates electronic bill boards, radio, magazine, and other forms of online marketing into its messaging.

“When we launched Dock86 we even wrapped the Minneapolis Light Rail transits and buses with our logos,” Johansen said. “Due to the huge amount of marketing we do its hard to put your finger on the most effective tool. We believe it’s a combination of everything that gets the word out about our brands and what is going on and why they should come in to buy today.”

Looking Ahead

Johansen believes HOM in a great position to grow all its brands into current markets and expand into new ones.

“We are very fortunate to be in a strong financial position to make moves when they present themselves, and our ownership has the vision to see around the corner,” he said.

Look for the Internet to play a greater role in the business.

“Whether its Amazon, Ashley, Wayfair, or Target.com they are all investing very heavy into their online capabilities and as consumers get more comfortable shopping (and buying) online that medium will continue to play a critical role in our industry,” Johansen said. “I do not think the Internet will take the same market share in furniture that it has in electronics but it will continue to grow at a much higher pace then the rest of the industry.“The Internet is absolutely critical to the future of our business. We’ve hired a whole team of Web designers and programmers who know the systems and the language.”

In late November, the store launched a new version of HOMFurniture.com that looks to optimize online customer service and e-commerce capabilities.

“Our long-term strategy is to do more nationwide selling and shipping, but our goal today is to support our existing customers who might want to purchase online,” Johansen said. “They can schedule a delivery or store pickup, too.”

While HOM’s delivery routes extend across multiple states, Johansen said the retailer is in no hurry to build out its e-commerce efforts further afield.

“If someone want’s a lamp in California, we can do that, but we aren’t ready yet for national shipment of a bedroom set,” he noted. “For now, we mainly want to give the (e-commerce) convenience to our local customer.”

January 12,

2015 by in Bedding, Product

The mattress category remains one of the shining stars in the furniture industry, and the close of 2014 was no different.

Through the third quarter of 2014, the most current figures, mattress sales totaled $9.7 billion, a 4.5 percent increase through the same quarter of 2013.

That’s good news for retailers who sell sleep surfaces, and even better news is that the most recent Home Furnishings Business consumer survey on mattress purchasing shows that consumers are for the most part pleased with their latest bedding purchase.

More than half (53.7 percent) of our consumer panel bought a traditional innerspring bed. That percentage was followed by memory foam with 37 percent opting for that construction. From there, the next closest sleep surface option was air at 5.6 percent. Most of our consumers bought mattresses for the master bedroom (77.4 percent) with guest bedrooms placing a distant second with 20.8 percent. Queen mattresses remain the top selling size with 46.3 percent of consumers acquiring them.

Bedding consumers remain price conscious with more than 77 percent spending less than $2,000 for their mattress purchase. In fact, price ranked as the most important factor in buying a mattress following by rest test options, brand and recommendations by a retail sales associate. Never underestimate the need for consumers to rest test a bed. More than 53 percent spend at least 10 minutes testing a mattress in the store. Thirty-seven percent of them opt for 15 minutes or longer.

Price constraints were a drawback for consumers who considered a memory foam mattress but bought an innerspring instead. More than 35 percent said the price was cost-prohibitive. More consumers bought from a bedding specialty retailer (37 percent) than other retail channels, while more than 22 percent bought their new mattress from a traditional furniture store.

Overall, our consumers were pleased with their shopping experience. More than 62 percent of our panel rated their shopping experience as “enjoyable” to “very enjoyable”. The sales associates’ product knowledge also pulled in kudos with 68 percent saying they were “satisfied” to “very satisfied” with the service.

Want More?

A more in-depth report on the bedroom category is available for purchase at FurnitureCore.com—Industry Info—Industry Reports—Bedding or by calling Natalia Hurd at (404) 390-1535.

Vendors Say

Thomasville Synchrony from Boyd Specialty Sleep

"Thomasville Synchrony air beds have patented six-chamber cores, layers of gel memory foam and feature IntelliTemp phase-change materials in the covers. They also come with an LCD hand control that shows graphics and settings in color. These beds sell well because they're very attractive, have demonstrable features and feel great." Retail is $2,999, queen.

Denny Boyd

Boyd Specialty Sleep

Spring Air Sleep Sense Hybrid Plus with Eurotop

“The Sleep Sense Hybrid Plus is by far one of Spring Air’s best-selling Back Supporter-branded beds. It offers consumers a unique look and feel, and retail sales associates like to sell it because it has a very demonstrable selling story: its patented ‘hi-lo’ core design delivers more support where the body needs it most.” Retail starts at $1,299, queen.

Rick Robinson

Spring Air

Dormeo Dolce Tranquility

The Dolce Tranquility from Dormeo features three layers of the company’s Octaspring technology and an Eco-cell core. The mattress features a plush-to-medium-firm feel, and appeals to couples looking to compromise on a feel that they both like. The price point is much better than other comparable options. Retail is $2,999.

Glideaway’s Clarity

The 12-inch Clarity from Glideaway features three inches of high-density memory foam, three inches of convoluted gentle support transition foam and a six-inch support core. The mattress offers a high-end look and features with an affordable price. Retail is $899-1199, queen.

Gold Bond Smart Series 3000

Part of the company’s first hybrid collection, Gold Bond’s Smart Series 3000 offers the support of an innerspring with the added comfort of a top layer of gel. The mattress is a winner because it provides the benefits of hybrids at an affordable price. Retail is $1,399, queen.

Valencia by Kingsdown

Valencia uses the highest quality materials to provide the ultimate in comfort and support. Individually wrapped coils conform to the body for support and a latex and gel-infused memory foam provide a combination of conforming, resilient comfort. Retail is $999, queen.

World’s Best Bed by Pure LatexBliss

Designed to appeal to a variety of consumer needs, the World’s Best Bed provides technology for warm or cold sleepers giving sleep partners a happy compromise. Incorporating gel into the ticking places it closer to the sleeper’s body optimizing the cooling and comfort benefits to provide a good night’s sleep. Retail is $3,699, queen.

Restonic’s ComfortCare Signature Mattress Collection

The ComfortCare Signature collection from Restonic features temperature regulating Outlast and gel-infused memory foam and is wrapped in Burberry ticking. The collection, endorsed by consumers and winner of multiple consumer press awards, features Restonic’s Marvelous Middle construction for resilient support.

Serta’s iComfort Collection

Serta’s iComfort collection has had successful momentum with retailers and consumers since launching in 2011. The Savant EverFeel model is the 2014 version of one of Serta’s most popular iComfort offerings. It features the company’s Cool Action Dual Effects Gel Memory Foam, for cooling comfort and targeted support. Retail is $1,799, queen.

Retailers Say

Serta iSeries Merit Super Pillowtop

"Customers love the combination of specialty foam while still having the innerspring support system." Retail is $1,999 with two free specialty pillows.

Kyle Johansen

HOM Furniture

Coon Rapids, Minn.

Sleep to Live 600 Series

“It provides the ultimate comfort and more importantly — support comfort — that most other brands don’t have. Under the good, better, best categories, it’s in the better category offering the consumer a great night sleep without completely killing the budget.”

Retail is $2,399.

George Bruni

Art Van Pure Sleep

Warren, Mich.

Corsicana's Lockhart

“It is not something you can survive on by selling, but it is a great starting price point for the customer.” Retail is $299.

Woody Whichard

Midtown Furniture Superstore & Mattress Center

Madison, N.C.

Serta's iSeries Vantage

“Number one, it's made right here in Detroit. Second, Serta's done a great job providing two operations with iComfort and the iSeries.” Queen mattress retails for $1,074.

Jeff Selik

Hillside Furniture

Bloomfield Hills, Mich.

January 12,

2015 by in Business Strategy, Executive Changes, Industry

Satya Tiwari, president of rug, decorative accessories and accent furniture vendor Surya, has been steering the company since 2004. During that time, the company has blossomed into the go-to resource for retailers seeking a coordinated approach to their rug and accessories merchandising strategy. The company is in the midst of building a one-million-square-foot warehouse space and 60,000-square-foot office space in Georgia. The building will bring the company’s facility under one roof, a must Tiwari says to maintain Surya’s collaborative environment.

Home Furnishing Business: What’s your outlook for the home furnishings industry in 2015?

Satya Tiwari: I think 2015 will be great. The economy is growing; gas prices are lower leaving consumers with more money; housing is making a comeback. All indicators show that this will be a strong year for our industry.

For our organization, growth is very important. We want to grow by capturing more market share with our existing categories and by helping our customers grow their accessories business.

HFB: It’s been a big year for Surya with the planning of the Cartersville, Ga., facility and other initiatives. What’s driving your growth?

Tiwari: For sure. We are investing for the future. At the end of the day, the market we sit in is immense. In all our categories, it’s a big industry. We compete against Restoration Hardware, Pottery Barn, Crate & Barrel. These guys have done a great job. Our value isn’t just selling our retail partners product, but in being their service center.

We have to be first class in sourcing, merchandising, logistics. We have 6,000 customers. The question is how do we help them capture a higher share of the accessories market. That’s an area where our partners can use our help. At the end of the day, a great sofa is a great sofa, but it’s not the sofa, but how retailers help consumers visualize it. It’s all in how they capture the end consumer’s attention.

We truly take a collaborative approach with our retail partners and share information back and forth to enhance growth for us and for them. We listen closely to our customers. We’re one of the leading sources in collaboration with our partners. By putting our heads together, we can do great things.

HFB: Surya has been undergoing a large merchandising transformation with its leap from rugs to the addition of lighting, art décor and accent furniture. What’s the thought process behind the expansion into other categories?

Tiwari: We feel that accessories category has been a failure for retailers because they expand it to include too many suppliers. By expanding Surya’s category offering, we can help them better focus on that segment of the business.

We really are a service company, and as we continue on that path, we can help our partners be successful.

We have a very productive product development team. People just assume they’re only developing product, but they have created 10 to 15 lifestyle environments that encompass price, design aesthetic, ideas of types of houses and more.

It gives us a holistic understanding of the U.S. market. We use the environments to create the feeling, the texture, the warmth of a home. At the end, we develop product to meet these lifestyles. We visualize how the product will look in the environments and how it should be photographed. There’s a lot of thought that goes into our approach, and we have a number of people who travel the world to stay abreast of changing lifestyles.

HFB: Surya has partnered with a number of designer names for product launches. Can we expect to see more of those partnerships in the future?

Tiwari: We currently have a lot of strong names, and we want to digest and take the lines to the next level. We don’t want to overdo it.

We’re creating our own brand, as well as those with our partners. We want to strengthen those that we’re working with, but keep in mind, we look for partners with a design aesthetic, not just a name. Adding names is easy, but really connecting with them takes a lot of resources.

Although these names are important, we don’t want to become just a house of brands. It’s a delicate balance to maintain.

HFB: Surya has a heart for giving back. Talk about that passion. Where does the urge to give back come from?

Tiwari: At the end of the day, we’re humans. We live and work in a community. Let’s face it, selling a rug is not the sexiest thing. We’re not just here to sell products. Life has a higher calling, a higher meaning than that. Our goal has been to remain connected in the communities in which we work by supporting causes that mean something to us.

For the last five years we’ve been contributing to great causes, and those efforts connect our team in an important way. It shows us higher meaning of life; it helps keep us above the clouds.