Monthly Issue

From Home Furnishing Business

Missed Opportunities

February 8,

2015 by in Industry

By Tom Zollar

In the aftermath of the devastating Great Recession, we have tracked and reported the evolution of the consumer coming into your stores. They differ dramatically from the people we saw during the down turn.

Whether that change comes from a pent-up desire to finally buy something new for their home or perhaps a need to update their lifestyle, they are definitely on a mission. These directed, or driven, consumers tend to be more inclined to make a buying decision and are usually more selective in what they purchase – often being more focused on style and quality than before. Add to that the increased confidence gained from online research and a very high percentage of them arrive at your door ready to rock and roll.

Just as important, most home furnishings stores saw traffic levels return to pre-recession levels or higher last year. In fact, a lot of retailers, particularly those located in markets with better economic conditions, have been able to drive significant increases through aggressive advertising campaigns and high quality online marketing efforts. As a result, many enjoyed healthy business and, in some cases, record months during last year.

This is all good news, but when we look at year-end results, the real questions should be: Are we doing the best we can? Are we maximizing the potential this new customer and today’s marketplace offers us? Or, are some of us missing a great opportunity?

Before you answer, here are some things to consider:

· If today’s consumer comes into your store more driven to buy, more interested in better quality goods and more willing to custom order, then both close rate and average sales should be increasing for you. Are they?

· If the above is true, then even if your traffic was flat or only up slightly, you should have increased your sales nicely. Did you?

· If you increased your traffic, then your sales should have grown at an equal or greater rate as your traffic. Was that the case?

The bottom line is this. If store traffic was flat or only up slightly last year, a retailer still could have increased sales nicely by raising revenue per up, but for many that did not happen. Even in some stores that brought in more people than the year before, we saw flat or decreased sales. In several cases the percentage increase in sales was less than the increase in traffic. The only way that can happen is if revenue per up declined. This means they actually sold a smaller percentage of their traffic and/or sold each one less than they did in the previous year. Again, given today’s more driven, mission-oriented shopper that should not have been the case.

Here are two relatively extreme examples of what we have seen:

So what happened at stores that haven’t seen the level of improvement they could have potentially achieved?

The common denominator is in the area of staffing and the store’s ability to properly service the traffic they got. During the recession we saw most retailers downsize sales staffs by letting weaker ones go and through normal attrition. Since traffic was down, many of those people were not replaced. As the industry recovered, traffic did not jump for many stores, so they did not feel an urgent need to add staff. Often this is the result of pressure from the existing members since most sales people think more ups is the answer to their needs. We know there is a limit to how many customers each member of our staff can properly handle without seeing productivity drop. It varies greatly from person to person depending on selling style and how much design work they do, but everyone has a sweet spot and when they pass it, their efficiency and effectiveness go down.

The issue got even more complicated for some stores last year when even with staffing levels were historically adequate for traffic counts, they struggled to get the most out of it. A possible reason being that if you now have more customers interested in custom ordering products and redoing rooms than before, then they will most likely need more time to complete the sale – which means salespeople can’t properly interact with as many customers as they did before. Therefore even with the same size staff we might not be able to take advantage of our opportunities and maximize each sale.

In the above store examples, the first one added staff last year and while the second store added replacement staff holding staffing the same as the previous year.

The key factor seems to be that those stores that maintained. or enhanced. their level of service to the consumer, missed fewer opportunities and increased their revenue per up. They did this by allowing staff enough time to work with every potential client they greeted, so they could build the relationship each one wanted, solve individual problems, build dream rooms and maximize each sale. The stores that did not match their staffing level to the increased demands created by traffic and the needs of today’s consumer, saw a decrease in performance with each customer, leading to more missed opportunities and not achieving their potential.

This is pretty basic stuff for an experienced retailer. We know how important staffing is and how much it means to business, but in many cases we don’t know how to find the magic number. Instead, we end up going by gut feel or listening to our team. If that works for you, then keep it up. However, if you want a better picture of how many ups your staff can handle and still deliver peak performance, consider the following.

The best way we have found to determine each person’s ups sweet spot is by tracking, reporting and studying the relationship between traffic level and revenue per up for your store and each salesperson. While the obvious way to calculate revenue per up is to divide total sales by total ups, you might not know that multiplying closing rate by average sale gives you the same number. High school algebra would look like this—If Revenue = Ups x CR x AS, then if you divide both sides by ups you get Revenue/Ups = CR x AS.

Since closing rate and average sales are the main ingredients in a sale that the sales person delivers, then logically it means revenue per up is the best indicator of how well a person performs with the ups they have. It is a true reflection of efficiency and effectiveness. Therefore, if we track revenue/up movement compared to the number of ups a salesperson has each month, over time we begin to get a clear picture of how they perform with varying amounts of traffic. Doing the same for the entire store tells us how the sales team does. By putting it into a graph, it is easy to tell when we are missing opportunities by having a dramatically reduced revenue per up.

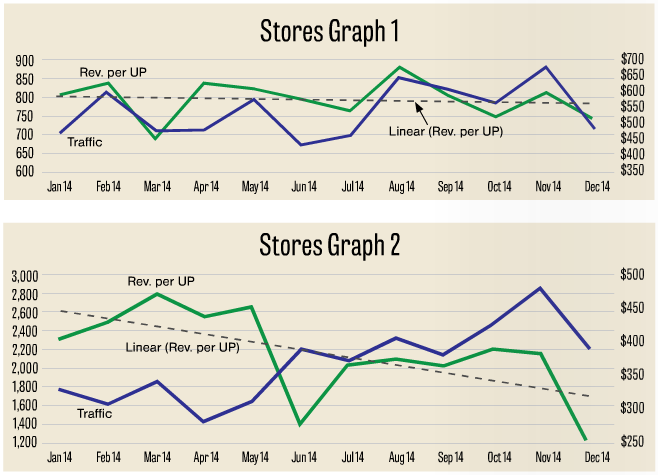

Below are examples of some store and individual results. The black line reflects the number of ups per month and the solid green line indicates the revenue per up each month. The dash green line is a trend line based on a two-month running average.

Stores:

Individuals:

It is fairly easy to see the impact the level of traffic has on the performance of both stores and individuals. There is always a point of diminishing returns, where the return you are getting from each up you bring in begins to sink. As you move past that the revenue per up continues to decline until at some point you are actually serving more people and selling less or at least not selling as much as you should be selling.

Our recommendation is to be very careful how often you let your floor go into overflow. That is when you see your staff’s efficiency and effectiveness sink to its lowest level. Chances are you lose more business on the busiest days than you do on all the others put together, and it is not necessarily because no one talked with them. Instead, they became a missed opportunity because they were not properly cared for by an overworked sales person.

Editor’s Note: Tom Zollar is retail operations practice manager for Impact Consulting where he creates and delivers sales training for retailer sales associates and managers, facilitates retail performance groups, coaches managers and helps retailers grow their business. In other words, he’s our resident coach … without the whistle.