Monthly Issue

From Home Furnishing Business

February 16,

2015 by in Green, Industry

By Sheila Long O'Mara

The greening of the industry is important, but consumers aren’t quite all in yet.

Let’s take a walk back in time. We in the furniture industry have been talking about the greening of the buisness for a while now.

The movement toward an industry that is more environmentally sensitive has been an up and down trail impacted by a number of things—the recession that hit, lack of consumer awareness and yes, even a bit of infighting among players in the industry. Thankfully, the cantankerous days are mostly behind us, and the movement has been making strides.

A number of big name retailers have put sustainbility at the forefront of their business strategy. I’m thinking Ikea, the Williams-Sonoma family of brands, Restoration Hardware, Crate & Barrel and Room & Board. Each of these brands have powerful name recognition among consumers, and they’re helping in their own way to create buzz around sustainability.

Smaller, more niche retailers have committed to taking big steps to make a difference in the greeing of furnitureland.

However, our target consumer isn’t quite there yet. She needs a bit more nudging and a lot more education on the matter. Nearly half of consumers in the latest Green Home Furnishings Study were not aware eco-friendly options were available in furniture. That’s a signifcant number in an industry filled with green choices and not so green choices. However, the bottom line is that the story, the craftsmanship and the benefit to the environment isn’t being told by the marketing departments. Nor is it being told on the sales floor while customers are in the mood to buy.

No great shifts in society ever happen overnight, in a few months or even a few years. The shift to sustainable home furnishings will ebb and flow, gain steam and lose momentum as we continue down the path; and external forces, like the economy, will continue to impact the progress we make.

The thought leaders—those that believe and lead others one small step by one small step—will evenutally make the difference. First comes one person, followed by two more, followed by a community. The furniture industry has those leaders who have already stepped up and are making a difference.

Here’s to more of those leaders willing to teeter on the edge for a better, environmentally friendly world, and to those who are eager to tell the story so consumers will care.

February 16,

2015 by in Economic News, Industry

By: Bob George

The term Tipping Point entered the business lexicon several years ago to describe an occurrence in the consumer sector. Made nearly famous by author Malcom Gladwell, the concept applies to the business sector as well. Simply put, tipping point is the instance of a previously rare happening becoming rapidly and dramatically more common.

For several years, Impact Consulting Services has conducted research on the topic of sustainability and specifically sustainability in the home furnishings industry. We have reached the magic number that indicates 50 percent of all consumers would be interested in buying green home furnishings.

The question now becomes what will it take to make green or sustainable or eco-friendly an established fact in the industry? According to Gladwell, author of the Tipping Point “The success of any kind of social epidemic is heavily dependent on the involvement of people with a particular and rare set of social gifts.” He notes these gifts specifically as connectors, mavens, and salesmen.

In his book, Gladwell defines each of those people as follows:

Connectors: “… people who know large numbers of people and are in the habit of making introductions.”

Mavens: “… ‘information specialists’, or people we rely upon to connect us with new information.”

Salesmen: “… are ‘persuaders’, charismatic people with powerful negotiation skills.”

What category do you fall into?

As an aside, I, as principal of Impact Consulting, was involved in a campaign several years back to set a minimum sofa cushion density of 1.8. It worked, and the industry is better for it.

We at Home Furnishings Business have provided the information. Let’s get started.

February 16,

2015 by in Economic News, Industry

Major shifts are occurring in the populations and purchasing habits of the four prime purchasing age groups for the furniture industry.

The two older groups—ages 45 to 54 and ages 55 to 64—are quickly surpassing the younger generations in size. Households ages 35 to 44 (Gen X), traditionally the core of the furniture industry, are in sharp decline. While the youngest age group tracked, ages 25 to 34 (Gen Y), has shown little growth since 2000, it does show great potential for the industry. As the second-highest birth rate generation, the numbers will be impressive as the group ages into the furniture buying segment.

Traditionally, furniture industry households have been divided into four age groups: 25 to 34 years, 35 to 44, 45 to 54, and 55 to 64. Consisting of more than 50 percent of the furniture buying population, the Baby Boomers (currently ages 49 to 68) have begun to exit out of the prime furniture purchasing years. Challenges face the industry as the group ages; especially in the next 5 to 10 years, as household formations slow.

The Rise of the Boomers

Since 2000, the rise in households has rapidly grown 68 percent due the successes of the Baby Boomers. In 2013, people aged 55 to 64, accounted for 26 percent of the furniture buying population. That’s up from 18 percent in 2000. People aged 45 to 54, currently including the younger portion of Baby Boomers, have increased in numbers by 15 percent since 2000.

While holding the greatest share of the furniture buying population in 2000, the Gen Xers, people between 35 and 44, dropped 11 percent to 24 percent in 2013. When compared with the Baby Boomers, Generation Y, those aged 25 to 34, have shown minimal growth since 2000. Gen Y grew 7.5 percent and made up 23 percent of total furniture buying households.

In 2007, the recession was hitting its stride and the older age groups surpassed the younger generations in numbers. Currently totaling 22.8 million households, ages 55 to 64 became the second largest group in 2011—a meager 5 percent lower than ages 45 to 54. As a combined group, predominately made up of Baby Boomers, it represents more than half of the furniture buying population.

Gen X households, which dominated the industry’s record growth in the late 1990s and early 2000s, are in sharp decline. In 2004, this prime family age group fell to second place in the race for the largest age segment, and in 2011 it dropped to third. The youngest group, Gen Y, holds the least number of households in the furniture buying population and has had consistently slow growth since 2000.

Spending vs. Age

Although Gen X is declining in numbers, it continues to lead the industry with an average annual expenditure of $527 in 2013, the most recent data available. On the flip side, the Boomers have grown in numbers, but their purchasing is 15.6 percent below Gen X furniture buyers with an average of $456 in annual furniture spending in 2013.

Table C illustrates annual expenditures by age group.

10-Year Historic Spending

Since the recession bottomed out in 2009, expenditures in most age groups have been steadily increasing to meet or surpass the average annual furniture purchase of 2002. Only one age group—45 to 54—in 2013, however, has come close to its spending levels from 2005.

The following four charts break down the historical furniture spending daty by age group.

While ages 55 to 64, the older Boomers, have made promising growth in spending since 2009 with an increase of 38 percent, the group spent 16 percent less per household on furniture than Gen Xers. The average spending is still down 14 percent to $456 per household for the Boomers from 2005 when they spend $527 on furniture.

Furniture spending trends by the largest age group — 45 to 54 — are shown in Table E. This group, split between the younger Boomers and the older Gen Xers, spent the lowest amount on furniture per household most recently. This group spent $422 on furniture in 2013.

That amounts represents a 6.8 percent drop from 2002 when the group was spending $453 on furniture and a slight 0.2 percent shy of its 2005 spending level of $423.

While sleeping in numbers, the 35-to-44 group, Gen X, has traditional spent the most per household on furniture. That trend continues, and Gen Xers have shown a 35 percent spending increase above their 2009 spending levels.

In the second quarter of 2013, the average Gen X household spend $527 on home furnishings, as shown in Table F.

The youngest group in among our furniture buyers, Gen Y encompassing those aged 25 to 34, is also the smallest in number. The group still spent on average $420 on furniture per household in 2013.

Gen Y appeared to be the least sensitive than older households in its spending habits during the recession. See Table G.

Future of Furniture Buying

Looking ahead into the next seven years, households in the age segment of 55 to 64 will continue to increase at a staggering rate. With an estimated 77 percent from 2000 to 2020, this segment will make up the majority of the furniture buyers.

Ages 25 to 34 are projected to increase 15 percent over the 20-year span, and those between ages 35 to 44—the prime furniture buyers—are expected to fall by 7.5 percent during the same period. The age group of 45 to 54 will have flat growth in 2020.

In 2020, age group 55 to 64 is projected to make up 19 percent of the furniture buying population, while the three younger generations will each account for about 16 percent.

February 16,

2015 by in Business Strategy, Industry

By: Sheila Long O'Mara

Kevin Sauder, president and CEO of Archbold, Ohio-based Sauder Woodworking, recently took the reins as chairman of the American Home Furnishings Alliance. He takes over as the industry is facing a number of regulatory issues and is sure to have a very full year. Sauder gave us a bit of his time recently to answer a few questions.

Home Furnishings Business: Share with me your outlook on the state of the industry for 2015. What are the challenges and what are the strengths?

Kevin Sauder: All signs point to a stronger economic environment for 2015, particularly with housing starts and the positive consumer feelings about lower gas prices. So we think furniture should have a good year. Sauder is booked solid through the first quarter.

Medium and higher-end furniture is a big-ticket, planned purchase, so it tracks more closely with consumer confidence, the stock market and housing starts. At the low end and in the ready-to-assemble (RTA) markets, we’re more tied to disposable income and the purchase of new electronics, such as TVs and computers. So we like to see low gas prices and innovations in electronics.

We’re fortunate in the RTA industry to make a product that ships well to consumers and is immediately available in inventory. The dot com channel, whether Internet-only retailers or combining bricks and mortar with online retailing, is a real growth area for our company because it takes advantage of these benefits.

HFB: What is the biggest obstacle facing the furniture industry?

Sauder: Other big-ticket purchases like cars and appliances spend huge budgets on innovation and advertising, which builds brand awareness and consumer demand for the newest thing. Furniture retailers like Restoration Hardware, Pottery Barn, Ikea, and Crate & Barrel have done a nice job of defining their niche and creating real demand for their products. It’s harder for more full-line retailers and manufacturers to create those “gotta have it” products to bring in the crowds without being tied to Labor Day promotions.

HFB: What’s your perspective on domestic manufacturing?

Sauder: More than 90 percent of our products are made in Archbold, Ohio, because we have a very productive labor force and a highly automated factory. Where it’s impossible to automate major portions of the production process, we’ll still need to import some complementary items. Domestic manufacturing can be a real benefit to the retailer with quicker response times, less inventory risk, and better quality control. But the Asian factories continue to improve and often represent real value for long runs of popular SKUs.

HFB: Where does the industry need to move in regard to the regulatory climate?

Sauder: We used to be reactionary to government regulation, ‘Why are they doing this to us?’ But once we started becoming more proactive and getting involved upfront with standard setting and testing, the industry developed a healthier relationship with agencies like CARB, EPA, and CPSC. Sauder offers our internal chemist to work on formaldehyde standards and our product safety director to help design safety tests. Ashley has done much of this as well. The AHFA also plays an important role in all of this. I think we need to keep being proactive to ensure our voice is heard and common sense legislation becomes the norm.

HFB: What would you like for your legacy as the 2015 AHFA president to be?

Sauder: I’m thrilled that they asked a guy who makes $99 TV stands for Walmart and Ikea to be the next AHFA president. The furniture industry is rapidly changing, the retail channels are evolving, and the regulations keep coming. We need to be very inclusive in utilizing the strengths of our entire AHFA membership and work together to grow our industry.

February 8,

2015 by in Industry

By Tom Zollar

In the aftermath of the devastating Great Recession, we have tracked and reported the evolution of the consumer coming into your stores. They differ dramatically from the people we saw during the down turn.

Whether that change comes from a pent-up desire to finally buy something new for their home or perhaps a need to update their lifestyle, they are definitely on a mission. These directed, or driven, consumers tend to be more inclined to make a buying decision and are usually more selective in what they purchase – often being more focused on style and quality than before. Add to that the increased confidence gained from online research and a very high percentage of them arrive at your door ready to rock and roll.

Just as important, most home furnishings stores saw traffic levels return to pre-recession levels or higher last year. In fact, a lot of retailers, particularly those located in markets with better economic conditions, have been able to drive significant increases through aggressive advertising campaigns and high quality online marketing efforts. As a result, many enjoyed healthy business and, in some cases, record months during last year.

This is all good news, but when we look at year-end results, the real questions should be: Are we doing the best we can? Are we maximizing the potential this new customer and today’s marketplace offers us? Or, are some of us missing a great opportunity?

Before you answer, here are some things to consider:

· If today’s consumer comes into your store more driven to buy, more interested in better quality goods and more willing to custom order, then both close rate and average sales should be increasing for you. Are they?

· If the above is true, then even if your traffic was flat or only up slightly, you should have increased your sales nicely. Did you?

· If you increased your traffic, then your sales should have grown at an equal or greater rate as your traffic. Was that the case?

The bottom line is this. If store traffic was flat or only up slightly last year, a retailer still could have increased sales nicely by raising revenue per up, but for many that did not happen. Even in some stores that brought in more people than the year before, we saw flat or decreased sales. In several cases the percentage increase in sales was less than the increase in traffic. The only way that can happen is if revenue per up declined. This means they actually sold a smaller percentage of their traffic and/or sold each one less than they did in the previous year. Again, given today’s more driven, mission-oriented shopper that should not have been the case.

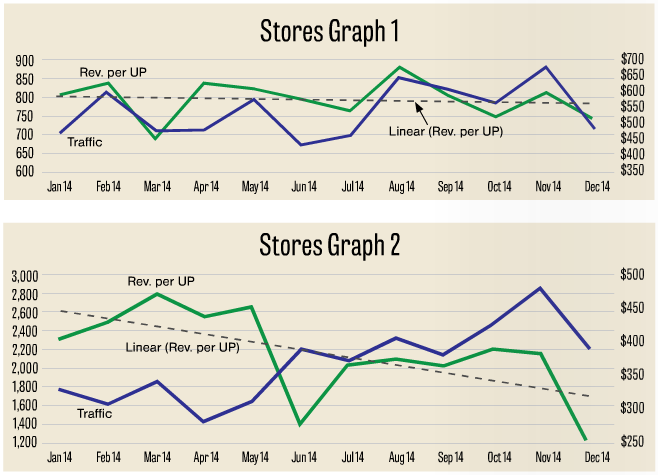

Here are two relatively extreme examples of what we have seen:

So what happened at stores that haven’t seen the level of improvement they could have potentially achieved?

The common denominator is in the area of staffing and the store’s ability to properly service the traffic they got. During the recession we saw most retailers downsize sales staffs by letting weaker ones go and through normal attrition. Since traffic was down, many of those people were not replaced. As the industry recovered, traffic did not jump for many stores, so they did not feel an urgent need to add staff. Often this is the result of pressure from the existing members since most sales people think more ups is the answer to their needs. We know there is a limit to how many customers each member of our staff can properly handle without seeing productivity drop. It varies greatly from person to person depending on selling style and how much design work they do, but everyone has a sweet spot and when they pass it, their efficiency and effectiveness go down.

The issue got even more complicated for some stores last year when even with staffing levels were historically adequate for traffic counts, they struggled to get the most out of it. A possible reason being that if you now have more customers interested in custom ordering products and redoing rooms than before, then they will most likely need more time to complete the sale – which means salespeople can’t properly interact with as many customers as they did before. Therefore even with the same size staff we might not be able to take advantage of our opportunities and maximize each sale.

In the above store examples, the first one added staff last year and while the second store added replacement staff holding staffing the same as the previous year.

The key factor seems to be that those stores that maintained. or enhanced. their level of service to the consumer, missed fewer opportunities and increased their revenue per up. They did this by allowing staff enough time to work with every potential client they greeted, so they could build the relationship each one wanted, solve individual problems, build dream rooms and maximize each sale. The stores that did not match their staffing level to the increased demands created by traffic and the needs of today’s consumer, saw a decrease in performance with each customer, leading to more missed opportunities and not achieving their potential.

This is pretty basic stuff for an experienced retailer. We know how important staffing is and how much it means to business, but in many cases we don’t know how to find the magic number. Instead, we end up going by gut feel or listening to our team. If that works for you, then keep it up. However, if you want a better picture of how many ups your staff can handle and still deliver peak performance, consider the following.

The best way we have found to determine each person’s ups sweet spot is by tracking, reporting and studying the relationship between traffic level and revenue per up for your store and each salesperson. While the obvious way to calculate revenue per up is to divide total sales by total ups, you might not know that multiplying closing rate by average sale gives you the same number. High school algebra would look like this—If Revenue = Ups x CR x AS, then if you divide both sides by ups you get Revenue/Ups = CR x AS.

Since closing rate and average sales are the main ingredients in a sale that the sales person delivers, then logically it means revenue per up is the best indicator of how well a person performs with the ups they have. It is a true reflection of efficiency and effectiveness. Therefore, if we track revenue/up movement compared to the number of ups a salesperson has each month, over time we begin to get a clear picture of how they perform with varying amounts of traffic. Doing the same for the entire store tells us how the sales team does. By putting it into a graph, it is easy to tell when we are missing opportunities by having a dramatically reduced revenue per up.

Below are examples of some store and individual results. The black line reflects the number of ups per month and the solid green line indicates the revenue per up each month. The dash green line is a trend line based on a two-month running average.

Stores:

Individuals:

It is fairly easy to see the impact the level of traffic has on the performance of both stores and individuals. There is always a point of diminishing returns, where the return you are getting from each up you bring in begins to sink. As you move past that the revenue per up continues to decline until at some point you are actually serving more people and selling less or at least not selling as much as you should be selling.

Our recommendation is to be very careful how often you let your floor go into overflow. That is when you see your staff’s efficiency and effectiveness sink to its lowest level. Chances are you lose more business on the busiest days than you do on all the others put together, and it is not necessarily because no one talked with them. Instead, they became a missed opportunity because they were not properly cared for by an overworked sales person.

Editor’s Note: Tom Zollar is retail operations practice manager for Impact Consulting where he creates and delivers sales training for retailer sales associates and managers, facilitates retail performance groups, coaches managers and helps retailers grow their business. In other words, he’s our resident coach … without the whistle.