Monthly Issue

From Home Furnishing Business

June 7,

2016 by in Economic News, Industry

Millennials, Americans born roughly between 1982 and 2000, account for more than one quarter of the nation’s population. As of 2015, these 17 to 34 year olds numbered 83.1 million and have surpassed the 75.4 million Baby Boomers. The Millennial generation continues to grow as young immigrants move into the U.S., while deaths among Baby Boomers exceed the number of older immigrants. These children of the Boomers will emerge into full adulthood in 2017 as the largest consumer generation in history.

This is the first of two articles profiling this generation. The initial article explores demographically how the Millennials have altered the population, income, education and household characteristics of both the Under 25 and 25 to 34 age groups over a ten-year period. The article next month will explore how researchers think this generation will spend its estimated $200 billion dollars annually starting next year.

Population

As a whole, the number of 15 to 34 year olds has grown 9.5 percent from 2004 to 2014 (most recent population data). As shown in Table A, the glut of Millennials is in the 20 to 24 age group – totaling 22.9 million in 2014 after jumping 12.6 percent in ten years. Ages 25 to 29 have also grown dramatically, increasing 15.7 percent from 19 million to 22 million. While dipping down to 19 million in 2008, age group 30 to 34 has climbed up to 21.5 million. The Millennial stragglers are in the top end of the 15 to 19 age group. Once the highest young adult population in 2006 and 2007, most have since aged into their twenties leaving this age group relatively flat at a 3.7 percent growth over the ten-year period.

Income and Employment

The economy has had a major impact on Millennials. Many of them still live with their parents, have crushing student loan debt and are underemployed at best and unemployed at worst. Over the past ten years individual incomes have yet to reach pre-recession levels. Latest median income figures from the Census Bureau report Millennials ages 25 to 34 earn $31,219 annually, down over 10 percent from a peak of $34,459 in 2007. Many of the Under 25 age group Millennials are currently part-time employed college students, underemployed graduates or workers in unskilled low paying jobs.

Education

The percentage of Millennials that are college educated is higher than any generation preceding it, a fact that should bode well for future economic growth. Over seventy percent of Millennials have some higher education (Table C) a much higher percentage than their Boomer parents.

Unemployment

Despite the level of education, a staggering number of Millennials are still looking for work. At the end of last year, 9.4 percent of adults ages 20 to 24 seeking jobs were still unemployed (Table D).

Marriage

Of all of the characteristics of Millennials, perhaps none is more significant to the home furnishings industry than the tendency to delay marriage (Table E). In less than ten years, the marriage rate shifted from 38 percent of adults marrying by age 34 to only 26.8 percent. Marriage spurs home ownership and family planning which in turn feeds the home furnishings industry.

Homeownership

Although Millennials make up the largest and most educated generation in American history, the combination of economic factors, delayed marriage and family formations and shifting consumer attitudes also make them the slowest to embrace home ownership. This is most evident in the 25 to 34 age group where home ownership has fallen 10 percentage points in 10 years. In 2004, 49 percent of Millennials owned their own homes compared to 39 percent in 2014. (Table F).

Furniture Expenditures

The glut of the Millennials, the Under 25 age group, is one of the few groups to increase expenditures on furniture in the last 10 years, although expenditures still comprise only about 5 percent of industry sales. Many of these Millennials, however, still rely heavily on family financial support. Millennials ages 25 to 34 as well as the older GenX 35 to 44 group, traditionally the core of the furniture industry, have both failed to reach pre-recession furniture expenditures – down 8.2 percent and 12.3 percent.

For the home furnishings industry, the Millennials always seem to be just over the horizon but yet to make their big entrance. In terms of furniture industry sales, sales to the Baby Boomers are still growing, but they will begin to lessen their impact and make way for the Millennials.

Many things add up to help explain the slow arrival of the Millennials on the home furnishings consumer scene. The long recovery from the recession brought stagnant wages and higher unemployment. Add to that the delaying of marriage and slow home purchases. But the industry is ready. In the next issue, Statistically Speaking will examine the attitudes and lifestyle characteristics of Millennials and whether home furnishings purchases will become as important to them as they have been to their Boomer parents.

June 7,

2016 by in Business Strategy, Industry

Literally every sales management training program I have seen during my forty years in our industry, has at some point made the statement “what is not measured cannot be changed” or something very similar! It is so basic to performance coaching that it is usually one of the first points covered and it is made abundantly clear that without the proper tracking, reporting and use of selling metrics, sales management will not be as effective as we need it to be! It is like having a map to navigate an unknown country with your desired destination plainly marked on it. Nice to have, but absolutely useless unless you consistently and constantly know where you currently are! The ultimate example would be the GPS system in your car that keeps you informed and allows you to make the proper course corrects in real time.

Owners/managers all have one goal or target that they do this with, since it is the main metric that drives their business – total sales volume. However, the major problem with only focusing on total revenue is that it is the end result of our efforts in so many areas within our business. Unfortunately, it is virtually impossible to improve a result if that is all you focus on! You just can’t “Coach” a result! You need to break it down into all of the individual factors that deliver what you want, then improve those that are deficient and maintain/maximize those that are sufficient.

As an example, a golf coach would never be successful if all he/she focused on was just getting the final score down to par. First it would have to be determined which aspects of the pupil’s game needed the most help: driving, fairway shots, chipping, putting, etc. Next they would work together on the behavior changes necessary in each of the weaker areas to cause improvement. The result would be an overall lower score, moving them towards the goal of par. Of course if it was my game we would not need to measure the individual facets to determine which to coach, since they ALL are bad!

Similar to golf, selling has a number of facets that greatly influence our end results. Breaking your individual staff member’s performance down to the basic areas that help them make the sales is the best way to know where to focus your attention, then observation and other tools will help guide your coaching/training efforts to deliver sales performance improvement. We have discussed a good deal of these sales management functions in previous articles, but here is a brief overview of the numbers you should be paying attention to and how to analyze them.

Four Key Effectiveness Metrics Tell It All

Effectiveness is a key issue in any environment in which person-to-person selling is the backbone of the business. To be successful in these situations high levels of individual interpersonal skills must be present. The only way management can determine if these skills are, in fact, being applied by salespeople is to measure those elements of sales performance that reflect their use.

Keeping in mind that Total Sales = Traffic X Close Rate X Average Sale, the following four measurements should be used to determine all baseline statistics (where you are now), to prepare on-going performance analyses and to develop goals (where you want to go).

Traffic is defined as: the number of potential customers (or family groups) who come into the store for any reason connected with the store’s business.

Most retailers call these “Ups”. This term derives from the colloquial use meaning that a salesperson is up to bat for this customer opportunity. Effectiveness is based on the number of opportunities that exist to make a sale. All opportunities must be counted because each one requires that a salesperson make personal contact with the customer or prospect. Traffic counts also provide the base measurement for determining close ratios and Revenue per Up, two important indicators of salesperson effectiveness discussed below.

Close Ratio is defined as: Number of sales divided by number of UPs, expressed as a percentage

Are your people connecting to their Ups? The key factor for calculation consistency is how you will measure the number of sales made. We strongly recommend that you combine all sales slips written for one customer on any one day by one salesperson into one total sale amount so that you are always measuring average sale and not average ticket. Doing this will ensure that you are getting a true picture of the total contribution of each sales process and are not inflating your close ratio due to administrative considerations. It is our experience that stores that measure only average ticket hold an unrealistic view of their close ratio that understates the need for training or improvement.

Average Sale is defined as: Total sales volume divided by the number of sales made, expressed in dollars

Are your people maximizing their opportunity with each Up? Here, again, the way the number of sales are counted will affect the outcome. Counting only the number of tickets will cause the average sale to be understated and will provide you with an understated view of performance. When measuring individual performance and comparing one person to another or one person to the store average, the conclusion to be drawn regarding higher performers is that they have the ability to recognize the greater needs of some customers. In other words, higher performers have and apply selling skills that lower performers do not possess or do not apply.

Revenue per Up is defined as: Total sales volume divided by the number of customers seen (UPs), However it can also be calculated by multiplying Close Rate X Average Sale

Revenue per Up is a critical measurement for use by management to understand the true effectiveness and efficiency of each salesperson. This measurement takes into account the effects of both close rate and average sale by combining their effects into one comparative index that indicates how many dollars of revenue are generated each time an individual salesperson greets a customer.

It is the variance among salespeople from high to low that shows the opportunity for store and individual improvement. This variance highlights the cost to the company of allowing high and low performers to have equal customer opportunities without making every possible effort to enhance the selling skills of the low performers. Keep in mind though, that Revenue per Up, like total sales, is a result that can’t be directly coached, it is mainly a “Red Flag” that makes you aware of how staff members are contributing to your business. Since Rev/Up = Close Rate X Average Sale, you must drill down to those numbers to find the driving factor for the performance.

The above four measurements are the most important metrics that should be used in all furniture stores’ sales performance analysis programs. However, in most stores there may be additional key performance measurements that should be considered. Here are a few additional performance numbers to track, report and coach:

Protection/Warranty Close Ratio

In many stores, Protection/Warranty sales is the most profitable product category and provides a significant contribution to the overall success of the company. Many stores currently only track the percentage of these sales to the total. Again, that is a result and can’t be directly coached. We recommend that this closing ratio be tracked, since it directly reflects how effective each person is at presenting these products to their customers and it can be coached.

Product Category Performance Percentages

It is extremely important to know how each of your staff members are performing in every product category a store sells. You will find that some of your people don’t sell bedding, others might fail to make the grade in case goods, a few don’t sell stationary well, etc. As an example, if your store has a lower average sale than it should, chances are you are under performing in Case Goods – find out who is pulling you down and fix it!

Sketching and In-Home Business Development

We recommend that Sketching be an integral part of every store’s selling process, but this is particularly critical in any store that deals in better goods and design or In-Home sales. Therefore, it can be very helpful to understand how many customers each staff member sketches with and how much In-Home business they are generating, based on appointments set up, made and sold.

Summary

Sales performance metrics are a management tool that should be used to better understand the dynamics of the store and to gain valuable insights into what is actually happening on the selling floor in the relationships between salespeople and customers. Comparative data should be used within a framework of clear goals, training, one-on-one coaching and counseling, and a structured feedback system. This is how to best develop a winning team and keep it winning!

June 7,

2016 by in Furniture Retailing, Industry

BY Trisha McBride Ferguson

While cocktail ottomans are gaining popularity as the place of choice for consumers to prop their feet or lay the remote, there’s no shortage of growth in the occasional table marketplace. From traditional to modern to farmhouse, today’s table styles help tie a room together while offering both fashion and function. No longer limited to identically matched sets of cocktail, end and sofa tables—consumers and designers are creating curated looks using carefully chosen tables to set a unique design aesthetic.

In 2015, occasional tables accounted for $3.3 billion in sales, a 5 percent increase when compared to sales of $3.17 billion in 2014. Sales growth in the category from 2013 to 2014 was notably lower at just 2.8 percent. In the overall home furnishings market, the occasional category accounted for 18.1% of total industry sales last year.

Greenington’s Rosemary Coffee Table

Edgy and eco-friendly, this coffee table is crafted of 100-percent solid bamboo. Its sophisticated lines reflect Mid-Century Modern influences. Suggested retail is $672.50.

Ferris Coffee Table NBWY-007 from Four Hands

The clever interplay of thick peroba wood slabs creates a modern take on the modular cocktail table. Its thoughtful design allows expansion from 48” to 76” wide. Suggested retail is $1,930.

Vanguard Furniture’s G231C Norma Cocktail Table

Part of its Barry Goralnick Collection, the Norma Cocktail Table features a metal base crafted in a French Brass finish. Its inlaid Agaria Marble Top adds both luxury and organic appeal. Suggested retail is $2,997.

Magnussen Home’s Bellamy T2491

Modern meets traditional in this stylish cocktail table crafted of pine solids and featuring brass hardware with a pewter overlay. Its classic scroll design gives it a timeless quality. Suggested retail is $

Stein World’s Vincent Cocktail Table 331

A table with a point to make, Stein World’s Vincent occasional group features a solid, inverted triangle-shaped base. It’s crafted in a mahogany tone finish and has a wood-framed glass shelf.

Ashley Furniture’s Traxmore Table T766-1

Wood and metal combine to create this unique cocktail table. Casual, medium-brown pine table tops feature removable wood serving trays and are supported by a slanted black metal base crafted from tubular steel and finished in a dark, textured, powder-coated finish.

Circles Cocktail Table from Hickory Chair

Inspired by an artifact on display in the collections of the New Mexico History Museum, this Made to Measure cocktail table is rich with historic influences. Its straight lines and clean silhouette give a nod to Arts & Crafts styling. Suggested retail is $3,225.

Klaussner’s Shoal Creek Cocktail Table

This multifunctional cocktail table is all about keeping clutter contained. It features a lift-top storage feature on one side and drawer storage on the other. Antique pewter metal legs and an “X” metal stretcher complement a light gray, ash finish and U-shaped drop bail pull hardware. Suggested retail is $

Jofran’s Beacon Street Cocktail Table 1649-1

Offering a new twist on a classic shape, this slatted-shelf cocktail table boasts a warm, multi-toned finish over solid acacia. It’s complemented by coordinating end, sofa, and chairside tables. Suggested retail is $199.99

Stickley Furniture’s 2016 Collector Edition Console

Equally at home in the foyer, living room or dining room, this console boasts dark copper hardware and three inlays made with sycamore, maple, cherry, makore, magnolia, and bird’s eye maple. Also includes back panel wire access cutouts and a power strip.

A.R.T. Furniture’s Epicenters Williamsburg Single Dresser

Featuring unique artwork created by a local artist and inspired by Brooklyn street art, this distinctive chest delivers plenty of charisma. Suggested retail is $2,079.

Borkholder Furniture’s Sienna Bench

Scaled for today’s living, this multifunctional bench features distinctive architectural elements. American-made and solid-wood, it’s shown in a brown maple finish. Suggested retail is $1,499.

June 7,

2016 by in Financial Reports, Industry

From all indications the storm has passed in 2015. Total furniture and bedding sales exceeded the 2007 peak. Financial performance has improved significantly from last year’s breakeven level to a much better 3-4% range for all traditional retailers. Is it time to breathe? From my perspective as an observer of the industry for the past 35 years, the answer is unfortunately not. Furniture retailing is like riding a bicycle. If you stop peddling, you slow down and eventually fall over. Unlike other business sectors that consider long term strategies, the time frame for a furniture retailer is much, much shorter. Regrettably for many retailers, the consideration begins when the situation is critical.

From a financial perspective, in 2015 it was relatively straight forward. Furniture retailers were able to increase margins over two percentage points. For the most part, this flowed to the bottom line. What gave retailers the impetus to increase margins? Was it better merchandise, improved consumer attitude, or was it the result of tighter margins at the supplier level?

The question becomes, “Is this a permanent solution or a short term fix?” As business slowed in this year with the industry up only 2.2% from Quarter 1 last year, will we panic and sell “price” or sell “financing”? The independent furniture retailer is up against significant competition from other distribution channels. The most immediate are the etailers (Internet) that have gross margins in the 24% range, but have yet to make a profit. Understandably, it takes significant investment to pioneer a new distribution channel. However, how long will investors endure the losses?

Interestingly, Amazon, one for the pioneers in this space, recently announced that they plan to open 300-400 bookstores. Now that they have captured significant share in the product category and caused the demise of bookstores, they are returning to opening bookstores. Maybe we can speed up the process of furniture and sell them the existing stores.

We recently completed some research that, contrary to popular belief, indicates more consumers visit the store before doing online research. Our take-away – we have an opportunity to sell the advantages of purchasing in a “real” store - the opportunity to see the product, to understand the quality and, most important, to be assisted in a major purchase by trained sales associates, associates who will work with the customer in creating the entire room. The final benefit is the delivery and installation by the company from whom the purchase was made.

We have the strategic advantage if we will use it not only with the Internet retailers, but also with the lifestyle stores who have limited selection and sales associates less skilled at selling the product. Keep pedaling, but it’s time to engage the next gear.

May 19,

2016 by in Financial Reports, Industry

As the traditional Mom and Pop furniture distribution channel matured shrinking into an ever-narrowing product offering, forsaking categories such as small appliances and housewares, retailers began to lose traffic. Each move resulted in fewer reasons for the consumer to come into the store and discover that bedroom group that they couldn’t live without. Even famed “dirty window stores” with their weekly payment plans have disappeared, in part, because of the regulations. For the most part, however, it was the transfer of our credit purchases to a third party credit card. Lost forever is the astute sales manager who knew exactly when the final payment was close and created an opportunity for the next purchase.

However, the one thing that has not changed is the old adage “Nothing happens until you sell something.” While some of the Mom and Pop stores have grown to regional chains, the one statistic senior management knows is the percentage of sales up or down compared to the same week last year.

What is true is a furniture retailer needs sales to prosper. Like all retailing, there is a fixed cost required to select (merchandise), present (store design/maintenance), sell (sales management) and deliver the product to the consumer. This fixed cost must be recouped before the first dollar of profit is secured. The next element is gross margin that can be achieved above the cost of the product delivered to the retailer’s store. While many retailers become entrenched in a pricing formula (keystone) which simplifies the pricing, this removes the opportunity to achieve the value of the product. From this gross margin must be subtracted the variable costs, such as sales commission, incremental delivery, and warehousing. There are also opportunities for improving the variable cost with reductions for delivery charges and protection sales. With all of these elements it comes down to what your breakdown as calculated below.

In other words, this revenue (breakeven) is what level of sales must be achieved before a profit is made. In the past the importance of the Fourth Quarter and “Black Friday” to retailers was well understood. However, in furniture, revenue has leveled out, removing the peaks caused by “tax refunds” and “crops in” facilitated by the fact that most consumers have the credit cards in their pockets. For furniture retailing this has been a negative because many smaller purchases can jump in front of the consumer’s planned redecorating project.

It's a Different Shopping World

Before the late 1990s, shoppers learned about products, trends and decorating ideas through very limited means compared to today’s standards. There were fewer than a dozen color home furnishings magazines available for ideas, such as House & Garden, Metropolitan Homes and House Beautiful.

Local stores were the best places to go for style ideas and furnishings ideas. For many, the stores were the only options. Shoppers often visited five to seven stores to uncover ideas for their homes, find the product they wanted and pay the price they could afford.

In the late 90s, the technology for cheaper production of color advertisements and magazines became available. The first cable home decorating and home improvement shows were created. Then came the Internet, where consumers could research style trends, products, services and pricing. Suddenly, consumers had a virtual library where they could educate themselves about home furnishings.

Today, consumers are time-constrained. At least 75 percent get information from the internet before visiting a retail store. They also seek the advice of friends. They make many decisions before they shop, including what store to visit first. Many now forego the store completely and buy online. Those who do shop in a brick and mortar store will typically end up visiting slightly more than two locations before making a purchase.

What are the obstacles?

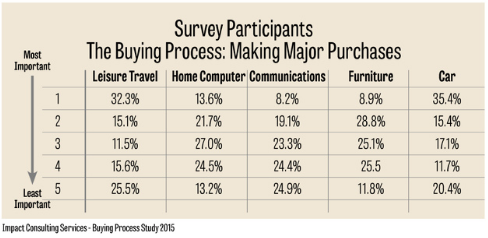

The first and most challenging effort is to get the consumer to allocate his or her disposable income to the furniture purchase. For years the fascination with the telephone (communication) and computers diverted the consumer’s expenditures from furniture. As can be seen in the following graphic, the consumer’s awareness may be turning. With an inspired consumer who is motivated to purchase, they begin the shopping process. There is not one way, but many paths to the end game. The following table presents the most common route to making a purchase.

Why Buy?

Buying furniture is not like a trip to the market for bread or milk; it’s not like a day at the mall to buy clothes for the family; and it’s not even like the purchase of a car. So what are the reasons for the consumer to purchase furniture? As one might expect, the highest percentage of purchases (38.1%) are made to replace current furniture. This reason is not surprising since furniture is a product that the family lives with every day of the year often going unnoticed by the daily users, suffering silently under the onslaught of animals, bouncing children, and spilled snacks.

After furniture replacement, the other most frequently mentioned reasons to make a furniture purchase were the desire for new furniture (31.3%), a recent move (26.8%), and redecorating (20.6%). The following graphic summarizes the other reasons.

Pre-purchase Shopping

The consumers were asked specific questions about their shopping experience. The following graphics present these findings. It is important to remember that what the consumer considered “shopping time” was most likely time spent in the stores looking at product. It is probable that the time spent researching the product, such as looking at product online or on a specific company website, was not included. Assuming that this is the time in the stores, the consumer did not spend a very long period before making his or her selection. The most frequent time period in this pre-purchase phase was two weeks to one month (27.5%) followed by the 1 to 2 weeks period (26.3%).

Number of Retailers Shopped Before Purchase

The average number of retailers that the consumers shopped is another indication of the pre-shopping mode the consumer was in. The highest percentage of shoppers only visited three retailers (38.3%) with an additional 23.7% of shoppers who only shopped two stores. This is indicative of a consumer who has done some pre-shopping “homework” before entering the furniture stores. On average the consumer shopped two stores. Now that the consumer is in the store the sales team is in play.

The Role of the Retail Sales Associate

When educated consumers come through the door of the retail store armed with research they have a clear picture of what they want. They are much more confident about selecting products for their home than were consumers in the 90s. They tend to think they don’t need the help of a sales person and are more inclined to say they are “just looking” even when they are actually looking for something.

This creates an issue for the sales associate who is usually on an ups program, working on commission (as does 90% of the industry). When he greets the shopper at the door, he gets the brush-off by a consumer who wants to browse. The problem is, most furniture retail stores are not like a grocery store, where one can walk through and see all there is to offer. Even if it was, people only “see” about 15-20 percent of what is in a store when they visit.

Keep in mind that, unlike the past, most shoppers who come through the door are there because they narrowed their choices and they came to your store. Therefore, it is crucial for sales associates to connect with every shopper who enters the store, even when they say they’re “just looking.” Include training that addresses creative ways of engaging customers and developing a relationship.

Because consumers approach the shopping and buying process very differently than they did 10 or even five years ago doesn’t it make sense that we may need to change the way we sell in order to be more successful at helping consumers? In addition, most younger employees don’t like the model, and the millennials coming through your door don’t like it either. You must have people on staff who understand, and can sell to, the newest generation of shoppers.

How Do You Keep Score?

The challenge of a retailer is to manage the retail sales associates, mentoring the new trainee to close the sale and the more seasoned associate to “build the ticket.” The following table shows the impact of incremental change in either.

Whenever the problem is, you ultimately end up at this chart. Why? Because sales is the only game.

WHAT ARE THE KEY PERFORMANCE INDICATORS?

Everyone knows the foundation of management is the establishment of method to measure results. The furniture product requires some interaction between the consumer and a knowledgeable individual - the retail sales associate (RSA). The ongoing discussion in the industry is how to define “knowledgeable.” The IKEA sales associate is available to answer questions with a staffing ratio of one sales associate to 2000 visiting consumers each month. IKEA’s much touted point of sale does the selling. Compare this to the upper end store staffed with retail sales associates who have design experience at a ratio of 1 to 60 monthly customers (Ups).

Sales Management on the floor, often unappreciated, is the key to performance. Maintaining a selling staff today is a challenge with most retailers reporting open slots in most stores. The challenge to keep and motivate retail associates is an ongoing one.

SALES PER SALESPERSON

The most basic measure of productivity is the salesperson. The following graphic (Graphic A) presents the recent performance. On average with all furniture store participants a level of $66,000 annually can be achieved. For the best performers the average is $74,000. The fluctuations with the larger retailer are the results of promotions.

The legendary million-dollar writer is alive and well [i]with most Best Performers having about 25% of their retail sales associates in the category. A key performance characteristic overall is the average tenure of the salesforce. Those retailers with ten years plus are typically in the top financial performance.

PERFORMANCE INDEX

The next basic measure is the performance index. Remove the debate around Ups and use the door counter adjusted down for 15% to account for the mailman and other non-purchasers and be consistent. The results should be compared to the statistics in the following.

Averaging $254 in sales per customer though the door for all retailers, Best Performance at $308 in sales per customer shows the potential. Comparing this number to the average advertising cost per Up measures your advertising performance.

SALES PER SQUARE FOOT BY SELLING SPACE

The average month translated to annual for all retailers is $219 compared to Best Performers at $249. The following graphic illustrates.

CLOSE RATE ANALYSIS

The most disputed number in our industry with excuses made for both good and bad performances is the close rate. The following graphic provides the performance.

In the past, good performance for close rate was 25%+ with an average of four stores shopped per purchase. Now, with only two stores shopped per purchase, good should be a 50% close rate. Yes, there are retailers achieving a 35% close rate.

The main point is to measures consistently and to work on incremental improvements. In our training practice we budget for a 10% improvement every year.

Footnote:

All data points are from FurnitureCore’s Best Practices application. Participants follow specific guidelines to insure accuracy of data.