Monthly Issue

From Home Furnishing Business

May 19,

2016 by in Financial Reports, Industry

As the traditional Mom and Pop furniture distribution channel matured shrinking into an ever-narrowing product offering, forsaking categories such as small appliances and housewares, retailers began to lose traffic. Each move resulted in fewer reasons for the consumer to come into the store and discover that bedroom group that they couldn’t live without. Even famed “dirty window stores” with their weekly payment plans have disappeared, in part, because of the regulations. For the most part, however, it was the transfer of our credit purchases to a third party credit card. Lost forever is the astute sales manager who knew exactly when the final payment was close and created an opportunity for the next purchase.

However, the one thing that has not changed is the old adage “Nothing happens until you sell something.” While some of the Mom and Pop stores have grown to regional chains, the one statistic senior management knows is the percentage of sales up or down compared to the same week last year.

What is true is a furniture retailer needs sales to prosper. Like all retailing, there is a fixed cost required to select (merchandise), present (store design/maintenance), sell (sales management) and deliver the product to the consumer. This fixed cost must be recouped before the first dollar of profit is secured. The next element is gross margin that can be achieved above the cost of the product delivered to the retailer’s store. While many retailers become entrenched in a pricing formula (keystone) which simplifies the pricing, this removes the opportunity to achieve the value of the product. From this gross margin must be subtracted the variable costs, such as sales commission, incremental delivery, and warehousing. There are also opportunities for improving the variable cost with reductions for delivery charges and protection sales. With all of these elements it comes down to what your breakdown as calculated below.

In other words, this revenue (breakeven) is what level of sales must be achieved before a profit is made. In the past the importance of the Fourth Quarter and “Black Friday” to retailers was well understood. However, in furniture, revenue has leveled out, removing the peaks caused by “tax refunds” and “crops in” facilitated by the fact that most consumers have the credit cards in their pockets. For furniture retailing this has been a negative because many smaller purchases can jump in front of the consumer’s planned redecorating project.

It's a Different Shopping World

Before the late 1990s, shoppers learned about products, trends and decorating ideas through very limited means compared to today’s standards. There were fewer than a dozen color home furnishings magazines available for ideas, such as House & Garden, Metropolitan Homes and House Beautiful.

Local stores were the best places to go for style ideas and furnishings ideas. For many, the stores were the only options. Shoppers often visited five to seven stores to uncover ideas for their homes, find the product they wanted and pay the price they could afford.

In the late 90s, the technology for cheaper production of color advertisements and magazines became available. The first cable home decorating and home improvement shows were created. Then came the Internet, where consumers could research style trends, products, services and pricing. Suddenly, consumers had a virtual library where they could educate themselves about home furnishings.

Today, consumers are time-constrained. At least 75 percent get information from the internet before visiting a retail store. They also seek the advice of friends. They make many decisions before they shop, including what store to visit first. Many now forego the store completely and buy online. Those who do shop in a brick and mortar store will typically end up visiting slightly more than two locations before making a purchase.

What are the obstacles?

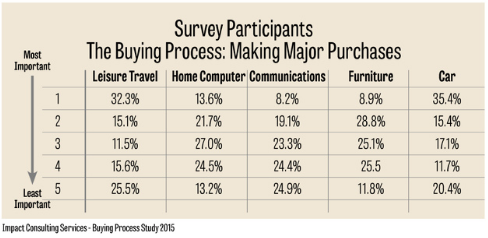

The first and most challenging effort is to get the consumer to allocate his or her disposable income to the furniture purchase. For years the fascination with the telephone (communication) and computers diverted the consumer’s expenditures from furniture. As can be seen in the following graphic, the consumer’s awareness may be turning. With an inspired consumer who is motivated to purchase, they begin the shopping process. There is not one way, but many paths to the end game. The following table presents the most common route to making a purchase.

Why Buy?

Buying furniture is not like a trip to the market for bread or milk; it’s not like a day at the mall to buy clothes for the family; and it’s not even like the purchase of a car. So what are the reasons for the consumer to purchase furniture? As one might expect, the highest percentage of purchases (38.1%) are made to replace current furniture. This reason is not surprising since furniture is a product that the family lives with every day of the year often going unnoticed by the daily users, suffering silently under the onslaught of animals, bouncing children, and spilled snacks.

After furniture replacement, the other most frequently mentioned reasons to make a furniture purchase were the desire for new furniture (31.3%), a recent move (26.8%), and redecorating (20.6%). The following graphic summarizes the other reasons.

Pre-purchase Shopping

The consumers were asked specific questions about their shopping experience. The following graphics present these findings. It is important to remember that what the consumer considered “shopping time” was most likely time spent in the stores looking at product. It is probable that the time spent researching the product, such as looking at product online or on a specific company website, was not included. Assuming that this is the time in the stores, the consumer did not spend a very long period before making his or her selection. The most frequent time period in this pre-purchase phase was two weeks to one month (27.5%) followed by the 1 to 2 weeks period (26.3%).

Number of Retailers Shopped Before Purchase

The average number of retailers that the consumers shopped is another indication of the pre-shopping mode the consumer was in. The highest percentage of shoppers only visited three retailers (38.3%) with an additional 23.7% of shoppers who only shopped two stores. This is indicative of a consumer who has done some pre-shopping “homework” before entering the furniture stores. On average the consumer shopped two stores. Now that the consumer is in the store the sales team is in play.

The Role of the Retail Sales Associate

When educated consumers come through the door of the retail store armed with research they have a clear picture of what they want. They are much more confident about selecting products for their home than were consumers in the 90s. They tend to think they don’t need the help of a sales person and are more inclined to say they are “just looking” even when they are actually looking for something.

This creates an issue for the sales associate who is usually on an ups program, working on commission (as does 90% of the industry). When he greets the shopper at the door, he gets the brush-off by a consumer who wants to browse. The problem is, most furniture retail stores are not like a grocery store, where one can walk through and see all there is to offer. Even if it was, people only “see” about 15-20 percent of what is in a store when they visit.

Keep in mind that, unlike the past, most shoppers who come through the door are there because they narrowed their choices and they came to your store. Therefore, it is crucial for sales associates to connect with every shopper who enters the store, even when they say they’re “just looking.” Include training that addresses creative ways of engaging customers and developing a relationship.

Because consumers approach the shopping and buying process very differently than they did 10 or even five years ago doesn’t it make sense that we may need to change the way we sell in order to be more successful at helping consumers? In addition, most younger employees don’t like the model, and the millennials coming through your door don’t like it either. You must have people on staff who understand, and can sell to, the newest generation of shoppers.

How Do You Keep Score?

The challenge of a retailer is to manage the retail sales associates, mentoring the new trainee to close the sale and the more seasoned associate to “build the ticket.” The following table shows the impact of incremental change in either.

Whenever the problem is, you ultimately end up at this chart. Why? Because sales is the only game.

WHAT ARE THE KEY PERFORMANCE INDICATORS?

Everyone knows the foundation of management is the establishment of method to measure results. The furniture product requires some interaction between the consumer and a knowledgeable individual - the retail sales associate (RSA). The ongoing discussion in the industry is how to define “knowledgeable.” The IKEA sales associate is available to answer questions with a staffing ratio of one sales associate to 2000 visiting consumers each month. IKEA’s much touted point of sale does the selling. Compare this to the upper end store staffed with retail sales associates who have design experience at a ratio of 1 to 60 monthly customers (Ups).

Sales Management on the floor, often unappreciated, is the key to performance. Maintaining a selling staff today is a challenge with most retailers reporting open slots in most stores. The challenge to keep and motivate retail associates is an ongoing one.

SALES PER SALESPERSON

The most basic measure of productivity is the salesperson. The following graphic (Graphic A) presents the recent performance. On average with all furniture store participants a level of $66,000 annually can be achieved. For the best performers the average is $74,000. The fluctuations with the larger retailer are the results of promotions.

The legendary million-dollar writer is alive and well [i]with most Best Performers having about 25% of their retail sales associates in the category. A key performance characteristic overall is the average tenure of the salesforce. Those retailers with ten years plus are typically in the top financial performance.

PERFORMANCE INDEX

The next basic measure is the performance index. Remove the debate around Ups and use the door counter adjusted down for 15% to account for the mailman and other non-purchasers and be consistent. The results should be compared to the statistics in the following.

Averaging $254 in sales per customer though the door for all retailers, Best Performance at $308 in sales per customer shows the potential. Comparing this number to the average advertising cost per Up measures your advertising performance.

SALES PER SQUARE FOOT BY SELLING SPACE

The average month translated to annual for all retailers is $219 compared to Best Performers at $249. The following graphic illustrates.

CLOSE RATE ANALYSIS

The most disputed number in our industry with excuses made for both good and bad performances is the close rate. The following graphic provides the performance.

In the past, good performance for close rate was 25%+ with an average of four stores shopped per purchase. Now, with only two stores shopped per purchase, good should be a 50% close rate. Yes, there are retailers achieving a 35% close rate.

The main point is to measures consistently and to work on incremental improvements. In our training practice we budget for a 10% improvement every year.

Footnote:

All data points are from FurnitureCore’s Best Practices application. Participants follow specific guidelines to insure accuracy of data.

May 19,

2016 by in Advertising, Industry, Product, Recliner

With the increasing demands of today’s overcommitted, technology-driven lifestyles, it’s no surprise consumers want to sit down and put their feet up. The motion upholstery category reflects this trend with 5.1 percent year to year growth from 2014 to 2015.

In 2015, total motion upholstery sales were $11.02 billion, with recliners’ share estimated at $4.74 billion. For the first quarter or 2016, the entire motion upholstery category is up 4.1 percent over first quarter of 2015.

While they’re looking for comfort, fashion and functionality are at the top of consumers’ shopping lists as well. Furniture designers have responded in a big way and are coming to market with a variety of styles, materials and options for every budget and décor style.

American Leather Comfort Recliner™

Featuring its best-selling arm style and a sleek tight back, the Fallon model shown here offers a variety of features and customization options including choice of chair size, arm and base, articulating headrest, and power or manual operation. Suggested retail is $2,999.

Bradington-Young’s Gallaway 3007

Offered in hundreds of cover options, the Gallaway 3-Way Lounger is shown here in an on-trend shade of gray (cover 9067-95) and is available in a variety of wood finishes with no upcharge. Suggested retail is $3295.

American Furniture’s 9930

Featuring a soft, tone-on-tone cover in Gazette Pewter, this timeless recliner continues to perform well on retail floors.

Flexsteel’s 1251 Brookings

This best-selling model is available as a handle-activated or power recliner and can be customized in a rainbow of leather or fabric choices. Suggested retail is $1,299.

Ashley Furniture’s 29501 Pranav

Consumers are responding to this updated twist on the traditional rocker recliner. The genuine leather model has sophisticated styling and contemporary flair.

Natuzzi’s ReVive

Designed to move with the user, this performance recliner intuitively responds to the body’s movement. Its innovative design ensures a seamless transition between body positions. Suggested retail is $2,500.

Craftmaster’s L361515

Classic never goes out of style, as seen with this top-performer from Craftmaster. Its rich brown leather cover is Galveston 08. Suggested retail is $1,199.

May 19,

2016 by in Business Strategy, Industry

Many of the articles you have read over the last decade in this magazine and others have carried a common message. That message has probably also been reinforced by every speaker you have heard at conferences and your own experience at your store. So by now, unless you have been in a cave somewhere, you have pretty much accepted the fact that the consumer has changed dramatically since the dawn of the 21st century. We know through research that the huge impact of increased color home furnishing advertising, home-focused cable TV channels/shows and particularly the internet, has both stimulated and educated our target customers so that they are much more product savvy and confident when they shop than they ever were.

As a result of their pre-shopping research, we know that they are visiting about half as many stores before buying. If we are making it onto their shorter list, then we should have a better chance of helping them find what they want and that has happened as we have seen an increase in closing rates over the past few years. However, as I stated in last month’s edition, even with all the research they do to select where they shop, we are still only satisfying about a third of those we see! So what do they tell researchers is the main reason for visiting a store and walking out without buying? According a Wharton Retailing Institute/Verde Group Retail Customer Dissatisfaction Study:

“Over-Cluttering,” combined with a sales associate’s inability to help in finding an item, are the top reasons for not making an intended purchase or simply going elsewhere.

So the biggest problem for all retail is:

• Confusion in store and lack of proper sales assistance!

Causing:

• The shopping Experience to not be what the new consumer wants

Therefore:

• Sales Person must be the problem because they failed to connect one-on-one and assist or direct the process in the store.

This has dramatically affected our industry, since many of our potential consumers actually anticipate a bad experience. As a result, as much as half of the home furnishings purchased in the USA this year will be bought through distribution channels that don’t involve salespeople as we know them in the process!

The truth of the matter is that if we have not properly trained our staff to deal with today’s customer by breaking through their fears and resistance to gain their trust, then we, the owners and managers, are really the ones at fault! Indeed, updated and effective Sales and Sales Management training is the answer for most retailers. So here are some ideas about how the Approach, Structure and Content of your program can provide the best training for your staff to deliver the impact you desire.

Approach

Historically, furniture stores that have consistently performed the best have also “trained” the best, from the top down. The best larger ones have invested in staff trainers and put in place continuous programs that keep the store management and sales staff informed and invigorated. This same type of effort is needed in any retail organization, no matter how big or small.

Unfortunately, most smaller stores tend to use “event based” training programs. In other words, someone comes to the store and holds a training seminar that usually gives good direction to the staff, sometimes actually reinvigorating or motivating them and as a result sales improve. The problem is that without the proper environment at the store, the improvement is not sustainable and a few weeks later the store’s business is flat again. Training is a journey, not an event!

In any successful performance oriented team, there is always a “coach” that drives the effort. Sometimes it is the owner, the general manager or sales manager who keeps the fires stoked. The truth of the matter is that everyone needs someone with the knowledge, the motivation and the courage to hug them when they need it and kick them in the butt when that is the appropriate action!

Therefore, you must make sure you have the proper “culture for success” in your store that will support and nurture all of the behaviors you train your sales staff to use. It is human nature to stop doing new things if they have not shown immediate results or are not yet a habit. Sales managers must hold their team accountable to provide the experience the store wants for each and every customer that visits, every time without fail. So the starting point for any sales program in your store needs to focus on first training management what to expect their people to do, how to teach it, track it, coach it and make it part of the store culture. Without that, whatever training you give the staff will just be treated like this month’s recommendation, not a way of life they need to embrace!

Once that is done, your sales training program should be focused on providing the service level and shopping experience that your target consumers want when they visit your store. There are many good ones available, but you need to make sure whatever one you choose has been updated and is focused on the needs of today’s customers, not the ones back in the 90’s and before!

Structure

The most successful programs utilize multiple types of training in an ongoing process that provides continuous improvement and development for their entire staff. This not only drives growth, but also creates an environment that the best people want to be a part of, which reduces turnover and helps you recruit/hire the most talented candidates available. Below is a list of some elements you can use to augment and enhance your manager led training efforts, plus a graphic that reflects the way each major part of a solid program can layer on to create the maximum improvement possible:

• Methods and Elements You Can Use to Enhance Your Results

– Natural or On-the-job Learning

– Individual Online and Video Self Learning

– In-Store Training Events and Seminars

– Management Training

– Performance Coaching for Managers and Sales Staff

Content

Management Training Program - Your strategy should be all about the customer, not the salesperson. It starts with creating management focus on coaching and needs to include the accurate measuring and reporting of your team’s individual performances. As has been discussed in previous columns, Total Sales = traffic X closing rate X average sale, so at the very least you need to have these numbers to study as you train, coach and manage your staff.

Your program should begin with the following important determinations and discussions:

• Defining the company’s vision

• Creating an understanding of your consumers:

– Their Lifestyles and Attitudes towards the home

– How they want to shop and be treated by your sales staff

• Instilling Principles of Business and a Belief system that works

It then needs to train the following Management and Coaching Functions:

• Measuring performance

• Recruiting - Hiring - Staffing - Scheduling

• Goal Setting & Management

• Training, Observation, Feedback and One-on-one coaching

• Motivating a Performance Team

• Managing Conflict

• Coaching the coach with ongoing support from upper management

Sales Training Program – All of your sales team’s efforts should be focused on providing the home furnishings shopping experience that your customer desires. Therefore, once you have the proper sales management organization and process in place, you need to train and coach your staff on how to provide a customer driven interaction that helps your visitors fulfill all of their wants and needs. It should include instilling behaviors that will deliver that result in the following critical areas:

• Preparation – Understanding your products and customers

• Greeting – How to break through “I’m just looking” and connect as a person

• Establishing trust – This is essential in order to maximize results

• Determining each customer’s Practical and Emotional needs by using the Sketch as an effective tool for gathering information – the problem is in the home, not the store!

• Presentation - Showing the right products, the right way

• Handling Objections - Techniques to enable the sale to continue

• Asking for the order/Gaining commitment - Timing and Techniques to help the customer make the right decision for their home

• Client Development and Follow Up – Creating Customers for life

Most retailers need some help putting a professional program like this together and there is plenty available. In the long run it is almost always quicker and more effective to hire someone who does this type of thing for a living! Talk with other retailers and find the provider that will make the right things happen in your store for you.

May 19,

2016 by in Economic News, Industry

Is an election year partly responsible for a healthy economy? Are furniture sales higher and unemployment rates lower? Looking back over the past 20 years and the elections those years encompassed yields interesting results. With the exception of the Great Recession in 2008, a possible heightened sense of confidence and hope for the future during election years may partly be responsible for higher furniture sales growth, consumer confidence, gross domestic product and lower unemployment rates.

Furniture Sales

In presidential elections over the last 20 years since 1997, the last year of each term with one exception, has produced the highest furniture industry sales growth of all four years of that presidency. The one exception was the second term of George W. Bush which ended during the Great Recession. The last year of each term is also the Election Year for next term, as the nation is experiencing now in 2016. If the pattern continues, 2016 should grow in excess of the 5.3% furniture sales growth of last year.

Table A shows the furniture industry growth by year over 20 years encompassing five presidential terms, including the current 2016 election. Note that the industry’s highest growth was in the last years of Bill Clinton’s second term and George Bush’s first term.

Consumer Confidence

Consumer Confidence was highest during the Clinton years – topping out at 139 during his last year in office (an election year). Taking a big dip post 9/11, Consumer Confidence dropped to 80 in 2003 before climbing back up to 96 during George W. Bush’s last year of his final term. During the Great Recession, Consumer Confidence hit its lowest at 45 during Barack Obama’s first term but grew 22 percentage points to 67 in the Election Year of 2012. Consumer Confidence has continued to grow over Barack Obama’s second term, but at 95 in March 2016, it is still below the 1985 base of 100.

Gross Domestic Product

The Gross Domestic Product or GDP is defined as the monetary value of all the finished goods and services produced within a country’s borders in a specific time period. As Table C shows, the GDP has made its largest gains during election years with the exception of the Great Recession. In both Bill Clinton’s 2nd term and George W. Bush’s 1st term, the value of U.S. goods and services increased by more than 6.5 percent from the previous year. It remains to be seen whether 2016 will follow the same trajectory.

Unemployment Rate

Like the highs in Consumer Confidence, the Unemployment Rate was at its lowest during the Bill Clinton years (Table D). The Great Recession caused the unemployment rate to skyrocket near 10 percent, but by the election year of 2012, the rate has decreased to 8.1 percent and continues to fall almost a percentage point each year. Currently at 4.9, the Unemployment Rate looks to be continuing the trend of other election years with the lowest unemployment of the presidential term.

Election Year vs. the First Year in Office

While the majority of election years in recent times have ended on a positive economic note for the furniture industry, did the momentum carry over to the first year of a president’s new term? The continued upswing did occur in the 1980’s and 1990’s, but since the turn of the century, furniture industry growth during a president’s first year in office did not surpass the election year preceding it.

Table E shows that in the 80s and 90s, with the exception of Ronald Reagan’s second term, the first year of a president’s four-year term experienced higher furniture industry growth than the previous election year.

Unlike the 80’s and 90’s, in recent elections (Table F), the economic momentum of the election year did not carry over to the first year of a presidency. No president’s first year of the term exceeded the previous election year’s growth. If this trend continues into 2017, the Furniture Industry will not experience quite the growth of 2016.

With America facing what pundits are calling a polarizing election year, the hope is that the U.S. economy will follow tradition and industry growth will continue and consumer confidence grow.n

May 19,

2016 by in Business Strategy, Industry

Institutions, companies, and, yes, magazines evolve through stages of growth. Each stage addresses the needs of its constituency while pushing the boundaries of its mission. This is true of Home Furnishings Business. The founding editor and publisher of Home Furnishings Business identified a need for a voice for the traditional retailer in the home furnishings industry. It was not to be a newspaper for the industry. Instead it was a publication that addressed for retailers the issues that were at the forefront of their concerns.

Over the past decade the industry has undergone significant changes with alternative channels of distribution challenging the traditional independent retailers and the migration of manufacturing offshore. The results are a declining retailer base and the loss of many established manufacturing brands sought by consumers. Today the demarcation between manufacturing and retailing is blurring. The movement offshore and the subsequent savings have been passed along to the consumers often with a reduction in product quality. Some retailers have assumed the role of suppliers, some with mixed results, but, for the most part, reducing the traditional supplier’s role to that of an importer. The results are a sector of the industry that is driven by price overlooking the primary focus of the consumer which is to create a beautiful and functional environment.

In 2013 the magazine changed ownership with the acquisition by Impact Consulting Services/FurnitureCore. This added another dimension to the acquirer’s mission to utilize and apply information to create high performance retailers and manufacturers. Changing the magazine’s masthead to “The Strategy Magazine of the Furniture Industry” and increasing its scope to include manufacturers and service providers was the first change. However, more than the cosmetic change was the addition of more specific content to allow readers to visualize their own business and to identify areas for improvement.

The content was authored by subject matter experts within the ranks of Impact Consulting with “Strategically Speaking” and “Coaches Corner.” The intent of this change was to establish a “point of view” of Home Furnishings Business concerning the home furnishings industry and the direction forward.

We continue this next phase of the evolution of Home Furnishings Business. We plan to explore the issues that are critical to creating high performance retailers incorporating business intelligence and market research along with input of industry thought leaders. Our goal is to raise the performance of the industry with critical discussion.

This is just as the process of our Performance Groups where active sharing increases the performance of all members of the group. We want to work with the industry to create that same atmosphere of striving for excellence.