May 19,

2016 by in Financial Reports, Industry

As the traditional Mom and Pop furniture distribution channel matured shrinking into an ever-narrowing product offering, forsaking categories such as small appliances and housewares, retailers began to lose traffic. Each move resulted in fewer reasons for the consumer to come into the store and discover that bedroom group that they couldn’t live without. Even famed “dirty window stores” with their weekly payment plans have disappeared, in part, because of the regulations. For the most part, however, it was the transfer of our credit purchases to a third party credit card. Lost forever is the astute sales manager who knew exactly when the final payment was close and created an opportunity for the next purchase.

However, the one thing that has not changed is the old adage “Nothing happens until you sell something.” While some of the Mom and Pop stores have grown to regional chains, the one statistic senior management knows is the percentage of sales up or down compared to the same week last year.

What is true is a furniture retailer needs sales to prosper. Like all retailing, there is a fixed cost required to select (merchandise), present (store design/maintenance), sell (sales management) and deliver the product to the consumer. This fixed cost must be recouped before the first dollar of profit is secured. The next element is gross margin that can be achieved above the cost of the product delivered to the retailer’s store. While many retailers become entrenched in a pricing formula (keystone) which simplifies the pricing, this removes the opportunity to achieve the value of the product. From this gross margin must be subtracted the variable costs, such as sales commission, incremental delivery, and warehousing. There are also opportunities for improving the variable cost with reductions for delivery charges and protection sales. With all of these elements it comes down to what your breakdown as calculated below.

In other words, this revenue (breakeven) is what level of sales must be achieved before a profit is made. In the past the importance of the Fourth Quarter and “Black Friday” to retailers was well understood. However, in furniture, revenue has leveled out, removing the peaks caused by “tax refunds” and “crops in” facilitated by the fact that most consumers have the credit cards in their pockets. For furniture retailing this has been a negative because many smaller purchases can jump in front of the consumer’s planned redecorating project.

It's a Different Shopping World

Before the late 1990s, shoppers learned about products, trends and decorating ideas through very limited means compared to today’s standards. There were fewer than a dozen color home furnishings magazines available for ideas, such as House & Garden, Metropolitan Homes and House Beautiful.

Local stores were the best places to go for style ideas and furnishings ideas. For many, the stores were the only options. Shoppers often visited five to seven stores to uncover ideas for their homes, find the product they wanted and pay the price they could afford.

In the late 90s, the technology for cheaper production of color advertisements and magazines became available. The first cable home decorating and home improvement shows were created. Then came the Internet, where consumers could research style trends, products, services and pricing. Suddenly, consumers had a virtual library where they could educate themselves about home furnishings.

Today, consumers are time-constrained. At least 75 percent get information from the internet before visiting a retail store. They also seek the advice of friends. They make many decisions before they shop, including what store to visit first. Many now forego the store completely and buy online. Those who do shop in a brick and mortar store will typically end up visiting slightly more than two locations before making a purchase.

What are the obstacles?

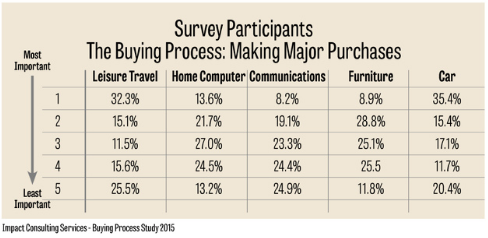

The first and most challenging effort is to get the consumer to allocate his or her disposable income to the furniture purchase. For years the fascination with the telephone (communication) and computers diverted the consumer’s expenditures from furniture. As can be seen in the following graphic, the consumer’s awareness may be turning. With an inspired consumer who is motivated to purchase, they begin the shopping process. There is not one way, but many paths to the end game. The following table presents the most common route to making a purchase.

Why Buy?

Buying furniture is not like a trip to the market for bread or milk; it’s not like a day at the mall to buy clothes for the family; and it’s not even like the purchase of a car. So what are the reasons for the consumer to purchase furniture? As one might expect, the highest percentage of purchases (38.1%) are made to replace current furniture. This reason is not surprising since furniture is a product that the family lives with every day of the year often going unnoticed by the daily users, suffering silently under the onslaught of animals, bouncing children, and spilled snacks.

After furniture replacement, the other most frequently mentioned reasons to make a furniture purchase were the desire for new furniture (31.3%), a recent move (26.8%), and redecorating (20.6%). The following graphic summarizes the other reasons.

Pre-purchase Shopping

The consumers were asked specific questions about their shopping experience. The following graphics present these findings. It is important to remember that what the consumer considered “shopping time” was most likely time spent in the stores looking at product. It is probable that the time spent researching the product, such as looking at product online or on a specific company website, was not included. Assuming that this is the time in the stores, the consumer did not spend a very long period before making his or her selection. The most frequent time period in this pre-purchase phase was two weeks to one month (27.5%) followed by the 1 to 2 weeks period (26.3%).

Number of Retailers Shopped Before Purchase

The average number of retailers that the consumers shopped is another indication of the pre-shopping mode the consumer was in. The highest percentage of shoppers only visited three retailers (38.3%) with an additional 23.7% of shoppers who only shopped two stores. This is indicative of a consumer who has done some pre-shopping “homework” before entering the furniture stores. On average the consumer shopped two stores. Now that the consumer is in the store the sales team is in play.

The Role of the Retail Sales Associate

When educated consumers come through the door of the retail store armed with research they have a clear picture of what they want. They are much more confident about selecting products for their home than were consumers in the 90s. They tend to think they don’t need the help of a sales person and are more inclined to say they are “just looking” even when they are actually looking for something.

This creates an issue for the sales associate who is usually on an ups program, working on commission (as does 90% of the industry). When he greets the shopper at the door, he gets the brush-off by a consumer who wants to browse. The problem is, most furniture retail stores are not like a grocery store, where one can walk through and see all there is to offer. Even if it was, people only “see” about 15-20 percent of what is in a store when they visit.

Keep in mind that, unlike the past, most shoppers who come through the door are there because they narrowed their choices and they came to your store. Therefore, it is crucial for sales associates to connect with every shopper who enters the store, even when they say they’re “just looking.” Include training that addresses creative ways of engaging customers and developing a relationship.

Because consumers approach the shopping and buying process very differently than they did 10 or even five years ago doesn’t it make sense that we may need to change the way we sell in order to be more successful at helping consumers? In addition, most younger employees don’t like the model, and the millennials coming through your door don’t like it either. You must have people on staff who understand, and can sell to, the newest generation of shoppers.

How Do You Keep Score?

The challenge of a retailer is to manage the retail sales associates, mentoring the new trainee to close the sale and the more seasoned associate to “build the ticket.” The following table shows the impact of incremental change in either.

Whenever the problem is, you ultimately end up at this chart. Why? Because sales is the only game.

WHAT ARE THE KEY PERFORMANCE INDICATORS?

Everyone knows the foundation of management is the establishment of method to measure results. The furniture product requires some interaction between the consumer and a knowledgeable individual - the retail sales associate (RSA). The ongoing discussion in the industry is how to define “knowledgeable.” The IKEA sales associate is available to answer questions with a staffing ratio of one sales associate to 2000 visiting consumers each month. IKEA’s much touted point of sale does the selling. Compare this to the upper end store staffed with retail sales associates who have design experience at a ratio of 1 to 60 monthly customers (Ups).

Sales Management on the floor, often unappreciated, is the key to performance. Maintaining a selling staff today is a challenge with most retailers reporting open slots in most stores. The challenge to keep and motivate retail associates is an ongoing one.

SALES PER SALESPERSON

The most basic measure of productivity is the salesperson. The following graphic (Graphic A) presents the recent performance. On average with all furniture store participants a level of $66,000 annually can be achieved. For the best performers the average is $74,000. The fluctuations with the larger retailer are the results of promotions.

The legendary million-dollar writer is alive and well [i]with most Best Performers having about 25% of their retail sales associates in the category. A key performance characteristic overall is the average tenure of the salesforce. Those retailers with ten years plus are typically in the top financial performance.

PERFORMANCE INDEX

The next basic measure is the performance index. Remove the debate around Ups and use the door counter adjusted down for 15% to account for the mailman and other non-purchasers and be consistent. The results should be compared to the statistics in the following.

Averaging $254 in sales per customer though the door for all retailers, Best Performance at $308 in sales per customer shows the potential. Comparing this number to the average advertising cost per Up measures your advertising performance.

SALES PER SQUARE FOOT BY SELLING SPACE

The average month translated to annual for all retailers is $219 compared to Best Performers at $249. The following graphic illustrates.

CLOSE RATE ANALYSIS

The most disputed number in our industry with excuses made for both good and bad performances is the close rate. The following graphic provides the performance.

In the past, good performance for close rate was 25%+ with an average of four stores shopped per purchase. Now, with only two stores shopped per purchase, good should be a 50% close rate. Yes, there are retailers achieving a 35% close rate.

The main point is to measures consistently and to work on incremental improvements. In our training practice we budget for a 10% improvement every year.

Footnote:

All data points are from FurnitureCore’s Best Practices application. Participants follow specific guidelines to insure accuracy of data.

August 22,

2014 by in Financial Reports, Furniture Retailing, Industry, Internet

E-commerce’s impact on the furniture sector shows no signs of slowing—and that affects all retailers, whether or not they sell furniture online. Based upon FurnitureCore's national consumer surveys conducted last year, of the consumers who purchased furniture, 17 percent purchased in on the Internet.

Of all consumers purchasing, 40 percent did not consider the Internet for the transaction, but that left 60 percent who did. Of the 60 percent who considered, 12 percent did not shop; 31 percent shopped, but did not buy. Still, that left a significant 17 percent who did purchase online.

To compare how the above consumers fared with independent furniture retailers, check out the accompanying “National Market Performance” graph from FurnitureCore.

Of all consumers purchasing, 48 percent did not consider an independent furniture retailer (excluding regional chains); 21 percent considered, but did not shop; 22 percent shopped, but did not buy; and only 10 percent purchased from an independent store—neither regional chains nor department stores.

NOT STANDING STILL There’s plenty of action among furniture stores moving into the online channel.

Take a look at Blueport Commerce, whose customers include brick-and-mortar retailers who want to extend their reach into e-commerce. Blueport recently announced that its sales are up more than 150 percent through 2014’s first two quarters compared with the first half of 2013. Sales for its Furniture.com e-commerce Web site are up more than 400 percent, comparing the same periods.

Part of the growth is attributable to a number of big name retailers who have joined the platform.

This year, $1.3 billion Canadian retailer The Brick signed up. Seffner, Fla.-based Rooms To Go has joined Furniture.com, and Ontario-based Leon’s plans to invest in Furniture.com and extend its Blueport contract for another seven years.

Those are just a few examples of how the big boys in furniture retailing are making moves. Such investments in time and money speak volumes about the present and future potential of the e-commerce channel for furniture.

FIRST STEPS Andy Bernstein, founder of Internet marketing and Web site services vendor FurnitureDealer.net, has seen growth in e-commerce’s importance in furniture retailing as consumers grow more accustomed to making online purchases.

In its business, Furnituredealer.net is focusing on two aspects to help clients address e-commerce: First, making it easy for consumers to use the site and buy online with a pure shopping experience; and second, communicating to consumers why they should buy from their client versus an online retail specialist.

“Ease of use means less clicking, easier navigation,” Bernstein said. “Second, is getting prices on the site.”

Regarding pricing online, retailers need to consider two aspects: inventoried product and special orders.

Manually pricing products is labor intensive. Bernstein pushes his clients to create Web sites that feature seamless access to price information through a store’s operating system.

“Forty percent of our clients (have sites) that are hand-shaking with their inventory management system,” he said. “It allows them to: one, communicate (to consumers) which products are in stock or in the store to see; second, it allows them to price it out” for special orders.

The hard part is up front, getting the Web site data set to match the store system’s data. Bernstein gave an example of the issues involved: If you’re selling a three-piece sectional or a seven-piece dining room, the shopper sees that as one “item,” while your store system sees an assortment of SKUs.

If a retailer is using photography from manufacturers online, it should match what is being sold. For instance, a vendor’s dining room image might show seven chairs, while a retailer sells dining groups with five chairs.

“Once you put a price on it with a picture, it gets tricky to make sure you get it right,” Bernstein said.

Custom orders pose a particular pricing issue for selling online, but progress is being made there, as well.

“We’ve been working hard on publishing manufacturer price lists that retailers can go to and put on a multiplier to get a price,” Bernstein said.

Manoj Nigam, president and CEO of Charlotte, N.C.-based Internet marketing and services vendor MicroD, believes a time will come when e-commerce won't be an option for furniture retailers, but a necessity.

"It's not a question of if, it's a question of when," he said. "E-commerce in our industry is in the same spot where Web sites were some years ago. Today, nobody questions the need for a Web site that shows your location, the products you carry, the services you provide."

Other retail sectors have created new online expectations for consumers that furniture stores must eventually match.

"The consumer expectations today are 'I can see it anywhere' and 'I can buy it anywhere,'" Nigam said. "When you are serving customers in any retail environment, you need to do it in an omni-channel way. That means the customer can see products in the store, go home an make a decision and purchase online; or find the product online and then come to the store to see and feel it, and make the purchase there."

Take a look at what other retail sectors are doing on line. Electronics, apparel and a host of others are meeting consumers' "see it anywhere, buy it anywhere" expectations.

"If you’re are going to be a retailer of any size, protect your market share, and come across as a company that's keeping up with the times, it's almost a requirement that you provide a click-and-mortar model," Nigam said.

Nigam does believe traditional furniture stores bring some advantages to the table.

"The online retailers' ticket size is typically smaller than that of brick-and-mortar retailers—for now," he said. "If you notice, Amazon is not in furniture in as big a way as appliances and other categories. Furniture is still one of the unique categories where consumers want to touch and feel, and that's a brick-and-mortar advantage.

"Big online retailers have created an awareness and expectation in consumers' minds. What (brick-and-mortar) retailers need to do to compete is to advertise and market in the channels people expect them to be like Google and social media, and promote their advantages" over online-only retailers.

For example, an online retailer can't hold in-store consumer events, and doesn't have a physical store where shoppers can experience the products in person. Retailers should tout their service stance and immediate, local recourse for consumers should problems arise.

"If you look at what's selling online (in furniture), it's mostly simple case goods, and not much in the high end," Nigam said. "If retailers sell specialized (custom order) upholstery, they need to promote that, along with the validation in the showroom of what shoppers see online. It's a huge advantage.

"Whether you sell online or not, advertise the fact that you're local and that you service what you sell."

How can retailers translate their store merchandising for a more impactful Web presence? Nigam had some suggestions. First, instead of single products, why not use a high-quality photograph of showroom vignettes? The items should could be sold as a package, but also allow shoppers to add individual items to their cart. This calls for a Web site robust enough to provide all the necessary information with a click.

"If you merchandise a group setting online with accompanying accessories and rugs, most sophisticated Web sites allow you to not only show that photo, but also have information on the individual items in the group," Nigam said. "We just launched a program with Havertys that allows you to slide in another rug and add that to the shopping cart. … The key is having a Web site robust enough to support your in-store merchandising and create a bridge to online merchandising."

Don't expect an immediate increase in sales once you step into e-commerce.

"I would say that having an online e-commerce presence is insurance in preserving your market share," Nigam said. "You might not have a lot of immediate sales, but not having the (online purchase) option is detrimental in customers' eyes. Hayneedle is selling every day in your market, and if you don't have the presence, you aren't even in the game."

And remember that a Web site with a shopping cart isn't the whole store for e-commerce. Your organization has to support inventory, delivery and after-sale service on items ordered online.

And while average tickets for online furniture purchases might not meet those of brick-and-mortar stores, expect that gap to shrink as consumers become more comfortable with big-ticket purchases via the Internet. MicroD manages Bassett's and Ethan Allen's online custom-order upholstery package.

"We've seen a steady increase in that sort of order online, and volume has steadily increased," Nigam said. He didn't give an exact figure, but the increase "is enough to where they've continued to support the channel."

THINK MOBILE An e-commerce Web site is more than a sales vehicle, it is today’s most valuable digital channel for driving traffic in to a physical store, according to Lance Hanish, co-founding partner of SOPHIS Integrated Marketing Innovations.

In developing that site, make sure to incorporate mobile-friendliness.

“Did you know that mothers turn to mobile when in store to save money?” Hanish asked.

If a retail site isn’t mobile friendly, consumers aren’t going to stay in the store long when browsing on the phone.

With e-commerce becoming more important, consumers have more ways to buy. If they use their phones in your store, make sure your mobile presence stacks up well with the competition.

“Today, everyone has a smart phone,” Bernstein said. “Every product has hundreds, if not thousands, of companies who can deliver it to (consumers), and they are operating inside your four walls through peoples’ smart phones.”

Suzy Teele, COO of Snap Retail, which has 2,500 retail clients across the United States and also works with designers and vendors, noted that starting last year, more online sales came over phones than computers.

“Does your product look good on the phone?” she said. “Use an app for mobile, or build a Web site that’s responsive, that readjusts its size automatically to fit the screen it’s appearing on.”

RETAILER RELEVANCE One way traditional retailers looking to take on e-commerce to compete with pure e-tailers is to do what they do best—talk to customers.

Bernstein is big on a full-service “assisted” shopping cart process.

“We see assistance from the retail associate as the most important part for the local retailers we deal with,” Bernstein said. “Our focus is not on the national-shipping part of e-commerce, but helping retailers do business better in the local market.”

That said, national shipping e-commerce players are a major competitive problem for retailers.

“Amazon wants to be the place where people buy everything,” Bernstein said, adding that a company such as home furnishings retailer Wayfair has the reach to get manufacturers to store product in their warehouses.

“The key is how do we communicate (online) why people should do business with our clients? What are your values, beliefs, services, community involvement? It requires a mind shift for us, because most of that information today resides in people’s heads, it’s not always published,” Bernstein said.

Most retailers tout their great service and knowledgeable, helpful people, along with selection or pricing, as reasons for consumers to shop and buy from an establishment.

“Get into the specific types of services you offer, the types of sales you do that differentiate, the types of financing you offer,” Bernstein said. “And tell them (online) why that matters to them.

“The Internet is going to commoditize a lot of products, and we have to communicate what value the retailer brings.”

Retailers should endeavor to build relationships and trust online. Retailers strive to do that in stores already?

“There’s going to be a huge need for retail salespeople and designers who can listen and help people solve problems online,” Bernstein said. “These people need to become experts at assisting customers over the phone and via chat and must have the tools they need to do that available.”

DEDICATING RESOURCES Do online shoppers browsing an e-commerce site see just the store’s telephone number, or are they directed to a dedicated call center when they want to buy or learn more?

The latter may be the better option. Think about it. Will a potential online customer wanting assistance call the store or go to the store?

Retailers showing particular online sales growth have established dedicated call centers for that segment. That way, the customer doesn’t get put on hold when she calls while the operator looks for the right person to field the inquiry.

“If you talk to the customer, that’s the moment of truth, and some of the best salespeople aren’t comfortable with the technology,” Bernstein noted. To compete with pure e-tailers, “our clients need to try to get people to talk.”

Del Sol Furniture in Phoenix decided to create a dedicated call center for its online sales, which the retailer started last year.

Alex Macias, vice president, had decided to spend time taking Web site-generated calls himself and realized how important they are. After the first day, he realized Del Sol needed to invest in an online sales team and service department.

“Those customers who come to our Web site are as valuable as those who come into the store,” he said. “If your Web site is an online store, today’s online customers have a high expectation of service.”

The first key to staffing such a call center is finding someone on your sales force that truly understands your company. It could be someone who isn’t doing that well on the showroom floor. That person might thrive in an online sales environment.

“Your best sales associates on the floor aren’t always the ones who have the skill for online sales support,” Macias said. “It’s a different skill set.”

A NEW CUSTOMER “There are a lot of people who have nice Web sites who don’t do e-commerce,” Macias said. “We consider our Web site to be our online store, 24-7, where the customers start the process.”

As it began selling online late last year, Del Sol had to make some adjustments. The store had catered traditionally to the Hispanic community with an emphasis on credit.

“That’s not the customer who comes to our Web site,” Macias said. While that traditional customer still leans toward in-store shopping, the online store attracted a much wider variety.

“Furniture retailers either get (e-commerce) or they don’t,” Macias believes. “Is your Web site just a Web site to you, or is it your online store?”

Even if you don’t sell online, it’s still a store.

“Look at leads coming in from the site. If they still think it’s just a Web site, they don’t get it,” he said.

ADDING VALUE ONLINE Furniture retailers have a depth of product knowledge sometimes lacking among pure e-tailers, and they need to make that resource available to online shoppers.

That’s one reason Sam's Furniture & Appliances in Ft. Worth, Texas, incorporates a live chat function on its e-commerce site.

“It's a great tool and gives customers another way to make contact with our stores when they have questions,” said Seth Weisblatt, vice president.

Consider incorporating e-mail marketing into your e-commerce strategy.

“I'm not talking about just e-blasts with promotions,” Weisblatt said. “We've started using prospect lead generation and it has had a great success. A customer provides their information to us via a pop up on the item page they are on, we will then follow up with targeted promotions for the products they were browsing for.”

Sam’s is constantly updating its Web site.

“From graphics, to product catalog, making sure every item has a price and stock availability,” Weisblatt said. “The ‘mission statement’ of our Web site is to provide customers the information they need to select Sam's Furniture as their place to shop.”

It’s all part of the retailer’s seamless shopping experience, whether the customer is in the store, on her computer, or using her smartphone or tablet.

“The more information we can provide customers the better our success will be online and in the store,” Weisblatt said.

SAVING THE DAY Goedeker’s, a furniture and appliance retailer in St. Louis, stepped into e-commerce after the recession hit in 2008 and crippled its business.

Owner Steve Goedeker said he launched e-commerce not as a grand strategy, but to keep the business afloat.

After starting e-commerce with 15 brands and around 4,000 products, the retailer now has more than 200 brands and a selection of more than 180,000 available items.

“We were just at the beginning of the recession in 2008 and were looking for a way to survive the challenges,” he said. “We started with a single table with two people, one who would answer the phone and one who worked on the Web site” adding and removing products.

As online sales increased, the Web site team went from two people seated at a table in the showroom to a separate, walled-off room with about a dozen people. The department moved upstairs when the online-employee count surpassed 20.

“Eventually we had to completely redo our building to accommodate more staff and inventory,” Goedeker said

Business grew to the point that two years ago, Goedeker’s converted 45,000 square feet of its 50,000-square-foot showroom into warehouse space and the hub of its online operations.

Selling online involved a tremendous cultural shift at Goedeker’s, with an explosion of information and an intimidating learning curve.

“It’s like starting all over again,” Goedeker said.

The Goedekers had no shipping experience and minimal knowledge of marketing.

“The challenges have been many,” Goedeker said. “From not knowing anything about how to start advertising, how to ship, how to deal with damages, hiring and training people. We literally were learning as we went along.”

There were also control issues. Along with delivery companies handling fulfillment came the need to hand over part of the business to an outside party.

SHOULD YOU SELL ONLINE? E-commerce represented 6.2 percent of total retail sales in first-quarter 2014, according to Snap Retail’s Teele, and is up 12 percent over the same period last year.

If there’s a single compelling reason to online for sales, she believes it’s that someone selling at least some of the product you offer is doing so online.

“A competitor might be supplying online the same item or service you do,” Teele said. “It might be a big-box retailer’s online (store) or an e-tailer with online sales only.”

She added that e-commerce is the No. 1 channel for electronics; No. 2 for apparel and accessories; and No. 3 for consumer packaged goods.

“It’s never flattening,” Teele said.